My latest piece is about labor strikes in the industrial sector, its implication for workers and economy, and the productivity issues hinged with these increasing wage and allowance. My point is that if the unions want to industrialists to double minimum wage (instead of simply adjusting existing wage with inflation), they should also guarantee that labor productivity would also double. Else, why double wages when the industrial sector is losing competitiveness and is in a downturn?

Union strikes & productivity

The trade unions and industrialists, who are represented by Federation of Nepalese Chambers of Commerce and Industry (FNCCI), have locked horns over increasing salary and allowance of industrial sector workers. This has halted production, including in Hetauda Industrial Estate. Meanwhile, the industrialists brave enough to resist the unions’ diktat are being admonished and manhandled by party cadres and union activists. The Maoist-affiliated trade union, All Nepal Trade Union Federation (ANTUF) has been the most active and belligerent in the whole union versus industrialist drama. The other two trade unions that are complicating the matter are CPN (UML)-affiliated General Federation of Nepalese Trade Unions (GFONT) and Congress-affiliated Nepal Trade Union Congress (NTUC).

While the demands of the unions are valid as per the existing labor law, they are far too stretched in terms of the need and ability of firms to fulfill them. The scale of demand for wage increase is beyond the capacity of most of the firms, which are seeing razor thin profit margins and some are falling short of the minimum demand required to keep up their operations running. In such a situation, demanding extremely high wages that are inconsistent with inflation rate and without a guarantee of an increase in labor productivity shows foolhardiness of the unions, who seem to be motivated to go for strike not for labor welfare reasons, but for political ones.

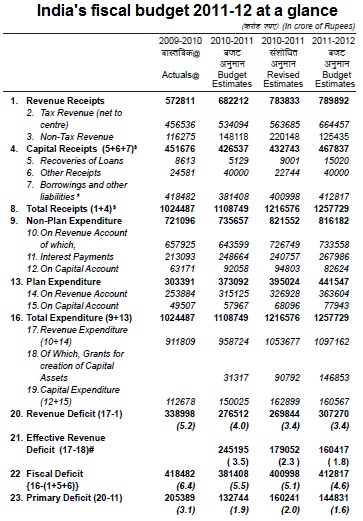

The existing labor law has a provision that allows the government to revise minimum wage every two years by consulting with both workers and employers. Two years ago, the government had fixed monthly salary of Rs 4600 (Rs 3050 basic salary and Rs 1550 dearness allowance) and wage of Rs 190 per day. The usual trend is that minimum wage is adjusted with inflation. Since inflation is hovering around 10 percent, it would have been justified if the unions’ demanded for an increase in salary and allowances by the same percent. However, they have asked for an increase in daily wage by more than double the existing amount. The industrialists argue that they can increase salary by 23.7 percent only. But, the trade unions want monthly salary to be increased to Rs 10,000 and daily wage to Rs 400. Furthermore, they are demanding additional provisions like insurance, provident fund and social security of workers. So, employers and unions are at loggerheads over wage, allowance and labor welfare issues.

Given the state of our ailing industries, it is pretty much impossible for them to fulfill the unions’ demands. If the unions stick to their guns, then there is no prospect for amicable solution to industrial discord, which is not only reducing production, but also labor productivity and eroding competitiveness of domestic industries. If the industries close down, then it will be the poor workers who will lose jobs, not the union leaders who are basking on political blessing and stash of cash from membership fees and (forced) donation. The trade unions should first consider the state of our industries and economy before making wild demands and going on for a strike that will do nothing but decimate our ailing industrial strength, which is essential for bringing about structural transformation in the economy.

Allow me to highlight some of the issues the unions leaders and union members should keep in mind before heedlessly going on strike demanding something that cannot be fully fulfilled, at least right now.

First, demanding pay hike during prosperous industrial periods is reasonable. Unfortunately, this is not such a time. No firm will increase salary beyond the mandatory adjustment of basic wages with inflation if profits do not rise. Worse, for some companies that are just making break-even increasing salary without corresponding increase in sales revenue will mean losses. Going on strike and halting production will further decrease firm’s revenue, which means not only employment and wage freeze, but also layoffs. By vehemently going into strike, the unions are not only depriving their own members of a potential salary hike in the future, but also employment opportunities to aspiring employees. The tragic fate of the garment and textile industries is still fresh in our memories.

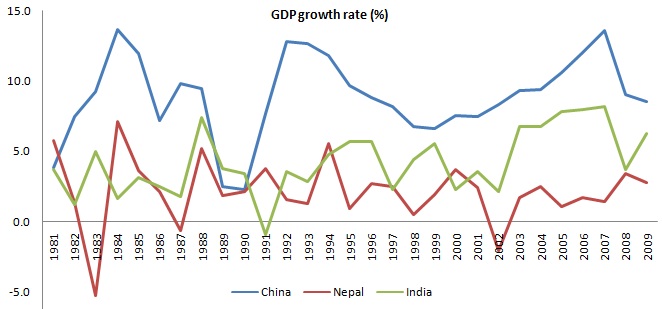

Second, the industrial sector is growing at a very slow pace. It registered negative growth rate (-0.2 percent) in 2009, down from a peak of 18.8 percent in 1992. Fortunately, it recovered slightly last year. Also, the industrial sector contributes just around 16 percent to our GDP and the manufacturing sector just about 6 percent. Against such a backdrop, how can the industries increase salary and allowance whose scale that is being demanded is not justified by the performance of any industrial variables right now? The willful act of the unions will further worsen the performance of the industrial sector.

Third, factors such as load-shedding, supply bottlenecks and donation campaigns are increasing cost of production of firms. It was reported that according to Small Factory Foundation Survey 2066, load-shedding has already forced closure of 41 percent of medium-scale factories. Furthermore, about twenty thousand workers lost jobs when five dozen big and small firms closed own in Birgunj-Pathalaiya industrial corridor of Parsa district. In such situation, without a decrease in cost of production, increase in profits is unimaginable. The pay hike (plus bonus and allowance) of workers depends on the rise in profits, which simply is not the case right now, thanks partly to destructive activities of the unions themselves. In fact, these factors have led to an increase in cost of production, eroded competitiveness both domestically and abroad, and led to a decrease in exports.

Fourth, low appropriability of private returns, i.e. the inability of the private sector to retain returns on investment, is taking its toll in industrial activities and economic growth. Poor property rights and slack contract enforcements engendered by the extralegal bullying of investors by the politically indoctrinated and militant youth wings and unions are falling heavy on the already ailing industrial sector. This is scaring away investors, both foreign and domestic. It will eventually cost jobs of the union members. The more destructive the unions get, the more it is going to cost the workers, industries and the country.

Fifth, remember that the militant activities of Young Communist League (YCL) severely crippled productive capacity and production in the industrial sector. It scared away foreign companies like Colgate Palmolive and shut down several garment firms. They not only harassed businessmen and terrorized business community by launching donation campaigns and confiscation of private property, but also illegally occupied industrial districts and disrupted production in several manufacturing plants in 2008. The very institution (private property) required for economic growth was handicapped by the YCL and Maoist-affiliated trade unions. In 2009, this was reflected in negative growth rate of industrial sector and a decline in annual GDP growth rate. Furthermore, net foreign direct investment inflow has been just 0.3 percent of GDP. The recent activities of the unions in the industrial sector bear the hallmark of the infamous industrial campaign launched by YCL in 2008. There is no benefit, but all loses in this endeavor.

Finally, can the unions guarantee that labor productivity will rise by the same proportion if salary and allowance are increased by the amount they are demanding? If not, then there is no point increasing salary and allowance beyond the one set by the minimum wage law and a simple adjustment with inflation. Note that, Nepal has the lowest labor productivity in South Asia. The labor unions should first convince the government and industrialists that labor productivity will increase if salary and allowance are increased. Then only their demands have logic. Else, there is every reason to speculate that all the drama staged by the unions has vested interests and are politically motivated.

[Published in Republica, March 24, 2011, p.6]

.jpg)

Here is my

Here is my

Recently,

Recently,