The IMF has updated its view on capital flows. Specifically, it now recommends that countries should have the option to pre-emptively curb debt flows to safeguard macroeconomic and financial stability. Excerpts from a blog post:

Economies with large external debts can be vulnerable to financial crises and deep recessions when capital flows out. External liabilities are riskiest when they generate currency mismatches—when external debt is in foreign currency and is not offset by foreign currency assets or hedges. [...]Since the beginning of the pandemic many countries have spent to support the recovery, which has led to a build-up of their external debt. In some cases, the increase in debt in foreign currency was not offset by foreign currency assets or hedges. This creates new vulnerabilities in the event of a sudden loss of appetite for emerging market debt that could lead to severe financial distress in some markets.

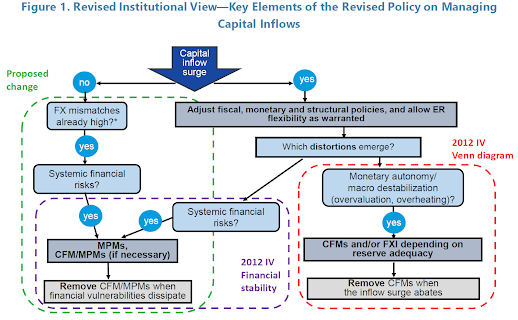

In a review of its Institutional View on capital flows released today, the IMF said that countries should have more flexibility to introduce measures that fall within the intersection of two categories of tools: capital flow management measures (CFMs) and macroprudential measures (MPMs). [...]these measures, known as CFM/MPMs, can help countries to reduce capital inflows and thus mitigate risks to financial stability—not only when capital inflows surge, but at other times too.

The main update is the addition of CFM/MPMs that can be applied pre-emptively, even when there is no surge in capital inflows, to the policy toolkit. [...]Pre-emptive CFM/MPMs to restrict inflows can mitigate risks from external debt. Yet they should not be used in a manner that leads to excessive distortions. Nor should they substitute for necessary macroeconomic and structural policies or be used to keep currencies excessively weak.

CFMs to restrict inflows might be appropriate for a limited period, the Institutional View said, when a surge in capital inflows constrains the policy space to address currency overvaluation and economic overheating. It said CFMs to restrict outflows might be useful when disruptive outflows risk causing a crisis. In turn, CFM/MPMs on inflows were considered useful only during surges of capital inflows, assuming that financial stability risks from inflows would arise mainly in that context.

Preemptive CFM/MPMs on debt inflows (primarily in FX) may be useful in the presence of private sector debt stock vulnerabilities (primarily FX mismatches), which MPMs cannot sufficiently address. Those stock vulnerabilities may have accumulated during prior inflow surges or gradually over time without an inflow surge. Preemptive inflow CFM/MPMs should be targeted, transparent and, while potentially longer-lasting, temporary, being recalibrated or removed as the vulnerabilities that led to their adoption subside, or if an effective MPM (that is not designed to limit capital flows) becomes available.In the context of capital inflow surges, inflow CFM/MPMs may be useful to address financial stability risks arising from the surge, and CFMs on inflows may be useful in the circumstances outlined in the Venn Diagram in Figure 2 (upper panel).