Watch this video (Mind Over Money) from PBS.

It is good to be reminded again and again the faults of rational models, its relation to the financial crisis, the warnings, the dismissal (from neoclassicals) and the way back to Keynesian ideas.

Watch this video (Mind Over Money) from PBS.

It is good to be reminded again and again the faults of rational models, its relation to the financial crisis, the warnings, the dismissal (from neoclassicals) and the way back to Keynesian ideas.

My latest piece is about the new industrial policy 2010 of Nepal. Nepal desperately needed an updated industrial policy to reflect the changes the national and the world economies have gone through in the past two decades. Here is my argument for why the industrial policy of 1992 should be changed. Here and here are my initial reaction when the cabinet endorsed the new industrial policy two weeks ago. Read the full text of Nepal’s industrial policy 2010 here.

Industrial Policy 2010: Good but inadequate reform

Despite the never-ending political uncertainty, something good happened in the economic policy front. A long-awaited industrial policy (IP) to buttress the domestic industrial sector was endorsed by the government two weeks ago. This new IP replaced the outdated IP of 1992.

The main objectives of the new IP are to promote industrial activity, increase employment generation, and boost per capita income. The government hopes to increase contribution of the industrial sector to the economy and expects a reduction in poverty. Though the new IP has numerous progressive and encouraging policy agendas, it is also riddled with loopholes and inconsistencies. It looks like a typical government document formulated without adequate consultation with associated parties and without prior appraisal by independent agencies.

The new IP makes it clear that the 1992 IP did not do a good job in promoting the industrial sector. The contribution of the industrial sector to GDP is decreasing, especially after the start of Maoist insurgency. Furthermore, it is paradoxical that the annual growth rate of the industrial sector is declining after the implementation of the 1992 IP. The dream of laying out a foundation for structural transformation, thus absorbing surplus agricultural and unemployed labor in the industrial sector, has remained a fairly tale.

Let me start with some of the salient features in the new IP. It promises flexible labor policy, including the ‘no-pay-for-no-work’ principle. It allows easy exit from business for promoters, freeing them from long-term labor and other liabilities. Tax and income rebate incentives and easy credit are offered to export-oriented firms. It promises tax holidays for 10, 7, and 5 years to firms that invest respectively in highly underdeveloped (21 districts), undeveloped (15 districts) and less developed (24 districts) areas. As always, it aims to promote Special Economic Zones (SEZs) and institute ‘one-window’ policy for all industrial activities.

It aims to promote value-added industries and facilitate supply and adoption of new technology to increase production and productivity. The government promises to purchase goods that are produced by domestic firms if there is 30 percent value-addition in the final product. Furthermore, it offers to establish a bunch of bureaucratic organizations to promote trade. It aims to upgrade technical and skill-related aspects of the existing administrations related to the industrial sector.

Great! It looks like a good IP, at least better than the previous one.

However, there are some inconsistencies and poorly-formulated plans that are worth mentioning. The document is indecisive in identifying the priority sectors, is ambiguous, and might distort incentives instead of enhancing them. Let me explain.

Despite numerous incentives, the IP is not clear if the overall strategy is either to ‘lead the market’ or to ‘follow the market’ or to do both. There is a danger that it might end up being an import-substituting policy in some sectors rather than promoting and sustaining competitive-edge of our industries. This is evident from the government’s willingness to impose anti-dumping duty and countervailing duty (CVD) on imports. If we injudiciously impose tariff and non-tariff barriers, then other countries might follow suit, especially on our exports. It will have negative impact on some sectors, as was seen when India imposed CVD, which it repealed recently, of 4 percent on Nepali exports. The most troubling aspect is the absence of sunset clauses in most of the proposed incentives. It might foster the dependence of the industrial sector on seemingly perennial concessions from the government.

There is no clear-cut identification and preference of industries based on national priority. The whole exercise looks like a spray-gun strategy trying to encompass everything under the roof of the industrial sector. Since the economy is resource constrained, both financially and in human capital, it should have promoted the industries that matters the most. It means tackling the binding constraints head on.

Our biggest constraint on economic growth is a lack of infrastructure, chiefly transport, energy and communication. The IP should have given utmost priority to addressing this constraint. This sector would be an obvious ‘winner’ with very little distortion of incentives. Why? Because domestic demand for infrastructure, energy and communication is higher than supply, offering a huge potential profitable markets. Moreover, there is tremendous demand for energy from neighboring Indian states. Bhutan is following this strategy and is growing at a phenomenal rate. There is no reason why we cannot do it.

The proposed “one-village-one-product” strategy seems nonsense, politically-charged and populist policy. It is a catchy slogan which basically means one village specializing in one product. This discounts the possibility of creating synergies among production processes and techniques, i.e. very little possibility for economies of scale and harmonization of products and production structure. How are we going to decide a product each village will specialize in? Similarly, will there be enough resources, financial and human capital, to bring about such specialization? This kind of open-ended and wooly strategy dilutes the very purpose of having a well-directed, specific and incentive-enhancing IP.

It offers varying incentives to industries willing to operate in less developed districts. This will not lead us much far because businesses, by nature, try to concentrate in places where their counterparts and complementary industries are operating. A firm will be disinclined to operate in less developed districts despite offer of good incentives, which might not offset the increase in cost of production incurred by operating in less developed areas. Simply constructing roads up to factory sites won’t suffice for the promotion of industries in rural areas.

Furthermore, rather than coming up with brand new programs, it would had been better to upgrade or overhaul the existing ones such as the promotion of the IT park, expediting the establishment of SEZs, and importing technologies to update the outdated technological base of the industrial sector.

There are endogenous and exogenous variables contributing to the decline of the industrial sector. The endogenous variables are utter ignorance and lack of domestic firms to increase price and quality competitiveness of products, and a habit of doing business under other’s tutelage rather than their own intellect and sound management. The business community relied more on concessions, of various nature and degree, derived by coaxing politicians rather than banking on their own ability to discover the potential to intrude and expand in new markets. This habit and nature of doing business became self-reinforcing once the nexus between business community and politicians became stronger. Additionally, it choked product specialization and diversification, further necessitating the need to seek political blessing for survival in the competitive market. It was evident from the failure of numerous export-oriented firms, the most infamous being the textiles and garment industry.

The most binding constraints on industrial activity are the exogenous variables such as lack of infrastructure and energy, deficient human resources, deteriorating labor and industrial relations, political instability and policy inconsistency. The state has to address these constraints decisively. Else, the IP’s effectiveness will be very minimal.

[Published in Republica, May 29, 2010, pp.6]

Martin Wolf blasts OECD's report, which myopically argues that "a weak fiscal position and the risk of significant increases in bond yields make further fiscal consolidation essential. But, we are not in a normal situation. This is a Keynesian time.

Above all, the private sector is forecast by the OECD to run a surplus – an excess of income over spending – of 10 per cent of GDP this year. On a consolidated basis, the UK’s private surplus funds nearly 90 per cent of the fiscal deficit. Thus, fiscal tightening would only work if it coincided with a robust private recovery. Otherwise, it would drive the economy into deeper recession. Yes, that is a Keynesian argument. But this is a Keynesian situation.

I agree that there needs to be a credible path for fiscal consolidation that would lead to a balanced budget, if not a surplus. That will be essential if the UK is to cope with an ageing population in the long term. I agree, too, that the path needs to be spelled out. Given the high ratios of spending to GDP – close to 50 per cent – the best way to proceed is via tight, broad-based, long-term control over expenditure. But a substantially faster pace than envisaged by the last government might threaten recovery: the OECD, for example, forecasts economic growth at 1.3 per cent this year and 2.5 per cent in 2011. Even this would imply next to no reduction in excess capacity.

Excerpts from a Foreign Affairs article on the influence of India and China in Nepalese political and economic spheres.

The Nepali crews that inch closer to China, bringing heavy trucks to a valley that has known only foot traffic, are at the forefront of a potentially major strategic shift in the region: Nepal, long a dependable ally and client of India, is building economic and political ties with China. Good roads are just one sign of this relationship and, as Rhoderick Chalmers, an International Crisis Group analyst in Kathmandu, explained to me, could "prevent India from using its ultimate sanction of economic blockade on Kathmandu." If China can begin supplying many of the goods that Nepal now receives from India -- especially petrol, diesel, and kerosene -- then India's leverage would be severely limited.

Although one new highway will not in itself push Nepal from India's sphere of influence -- history, economics, and above all, geography will see to that -- the mere fact that India may one day have to compete for Nepal's attention is a sign of Kathmandu's political reorientation. In 2006, as Nepal's monarchy teetered, Maoist leaders and pro-democracy parties signed a comprehensive peace agreement ending a decade-long civil war. Since then, Kathmandu has been building a nascent democracy while wedged in a proxy battle between China and India -- with the United States and Europe watching closely.

As Nepal inches toward a draft constitution and lasting peace deal, it is counting on India, its longstanding patron and a fellow Hindu-majority state. New Delhi remains Kathmandu's biggest supplier of essential goods, including gasoline, and the Nepalese are addicted to Indian films, music, and other forms of pop culture. Although new roads in Nepal's northern reaches may one day extend the country's economic linkages to China, for now the majority of all trade flows are to and from India in the south.

China's renewed interest in its southern neighbor is not entirely a quid pro quo. In Kathmandu, mobs of Chinese tour groups visit the tourist enclave of Thamel, where they frequent Chinese-run restaurants, bookstores, and hospitals. Meanwhile, Chinese cultural centers are popping up across the country, notably in the Terai, along Nepal's southern border with India. According to the Chinese embassy in Nepal, projects such as the Birendra International Convention Center -- a gleaming complex near Kathmandu's international airport -- and the capital city's main highway are evidence that "China treats Nepal as its closest neighbor and best friend."

Although the above initiatives aim to signify the softer side of Chinese-Nepali ties, China ultimately appears most interested in stifling "anti-Chinese" activities on Nepal's soil. And given China's single-minded focus, Communist Party leaders in Beijing seem less concerned with Kathmandu's political jockeying than with ensuring that the next government is as pliant as the current one. One strategy, analysts suggest, has been to focus fewer resources on national politics and more on localized economic aid, such as building schools in politically sensitive border areas. Although China may consider a return of communist governance ideal, its principal concern is stability. "For China, the ideological difference doesn't make any difference," said Dhungel, the presidential adviser. "They had very good relations with the king. They had a very good relationship with the Nepali Congress. And I think they will have relations with whoever emerges as a stable force."

This is a summary of Anna McCord’s paper (International PWP Comparative Study) on some of the major public works programs/social safety nets in the world.

PWPs are implemented under two broad labor market situations: (i) acute, short term fall in labor demand or livelihoods disruption (resulting from drought, flood, financial crisis or recession); and (ii) chronic high levels of under- or un-employment and poverty.

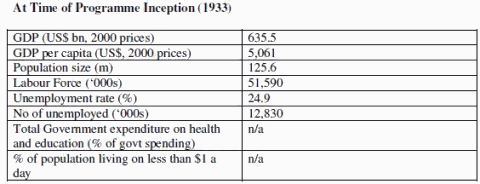

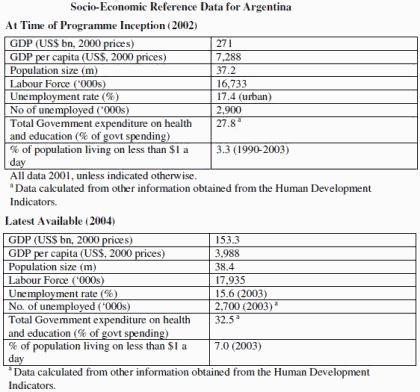

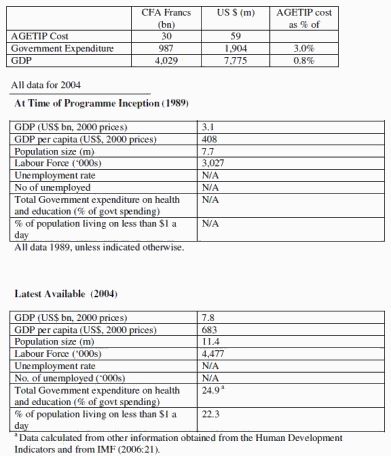

McCord reviews six public works programs: (i) USA’s New Deal programs, (ii) Argentinean Jefes program, (iii) India’s National Rural Employment Guarantee Act (NREGA), (iv) Ethiopia’s Productive Safety nets Program (PSNP), (v) Senegal’s AGETIP (Agence d’Execution des Travaux d’Interet Public, and (vi) Ireland’s Community Employment Program. She compares and contrasts these PWPs with South Africa’s Expanded Public Works Programs (EPWP) and offers some recommendations.

Broadly there are four types of objectives of social protection programs:

Usually large scale social protection programs, such as AGETIP, fail to attain substantial coverage and suffer from limited impact and seemingly inappropriate conception and design. NREGA avoids this danger of form over substance, in part due to close scrutiny to which it is subjected as a consequence of the highly organized role of civil society in monitoring anti-poverty interventions.

For measurement of the effectiveness of PWPs, the microeconomic impact of program participation (current and future earning and/or reemployment prospects) and the macroeconomic impact (net effect on aggregate employment and unemployment) are evaluated. The effectiveness of a PWP intervention in terms of its contribution to social protection is contingent on the appropriate duration of employment and the extent to which it enables livelihoods protection and/or accumulation to take place.

PWPs that are more likely to be successful in alleviating poverty in the context of persistently high levels of unemployment and poverty provide a guarantee of ongoing or repeated episodes of employment on a massive scale. Some form of job guarantee is included in the program.

Social protection consists of all initiative that provides income (cash) or consumption (food) transfers to the poor, protect the vulnerable against livelihood risks, and enhance the social status and rights of the excluded and marginalized. (see Devereux and Sabates 2004). The World Bank considers risk coping, risk mitigation and risk reduction as key components of social protection.

Social protection can be carried out through wage transfer (cash, food or inputs), asset benefits, and training or work benefits.

If employment were offered on a sustained basis, or were guaranteed in times of need, as in NREGA, with no sustained benefits accruing from the assets created,the program would confer prevention social protection, or risk mitigation. If there are sustained benefits accruing from assets created from sustained employment programs, then it could be termed as promotive/transformative social protection (social risk reduction).

Case studies:

1) The USA’s New Deal Programs (1933-43)

2) The Argentinean Jefes de Hogar Program (2002- )

3) Indonesia’s Padat Karya (PK) Program (1998-2001)

4) India’s National Rural Employment Guarantee Act, NREGA (2006)

5) Ethiopia’s Productive Safety Nets Program, PSNP (2005-)

6) Senegal’s Agence d’Execution des Travaux d’Interet Public, AGETIP (1989- )

7) Ireland’s Community Employment Programme (CEP) (1994- )

PWPs international comparison

With just a cost of 1% of GDP, India’s NREGA covered 15% of total labor force through PWP jobs. With 2% of GDP, Ethiopia’s PSNP covered 4.8% of total labor force through PWP jobs.

One of the most striking aspects of the recent recession is the collapse in international trade. This paper uses disaggregated data on U.S. imports and exports to shed light on the anatomy of this collapse. We find that the recent reduction in trade relative to overall economic activity is far larger than in previous downturns. Information on quantities and prices of both domestic absorption and imports reveals a 40% shortfall in imports, relative to what would be predicted by a simple import demand relationship. In a sample of imports and exports disaggregated at the 6-digit NAICS level, we find that sectors used as intermediate inputs experienced significantly higher percentage reductions in both imports and exports. We also find support for compositional effects: sectors with larger reductions in domestic output had larger drops in trade. By contrast, we find no support for the hypothesis that trade credit played a role in the recent trade collapse.

The tiny Himalayan nation’s garment industry in its heydays earned the highest foreign exchange for Nepal and was the biggest export-oriented manufacturing industry of the country.

Export of readymade garments (RMGs) that in 2002/2003 registered over 11.5 billion Nepalese rupees (165 million U.S. dollars) plummeted to about 4.5 billion rupees (65 million dollars) in 2008/2009. An industry that once provided direct employment to approximately 50,000 people, including a significant number of women, now just employs a few thousand people.The phasing out of the quota system carried out in tune with the 1990 World Trade Organization (WTO) Agreement on Textiles and Clothing (ATC) (also known as Multi-Fibre Agreement), Nepal’s inability to restructure the sector, political instability and the rise of unionism dealt a near-lethal blow to the industry.The quota reduction was implemented in four phases: 16 percent in 1995; 17 percent in 1998; 18 percent in 2002; and finally 49 percent in 2005, thus ending 40 years of quota-based trading on textiles and clothing."The quota phaseout under ATC began in 1995, but its impact on the Nepalese economy was not immediate. This was due to the fact that the RMGs were concentrated on a few products (mainly cotton casual wear), and these products were not under quota restrictions until the last phase of the Agreement," says a report published by South Asia Watch for Trade, Economics and Environment (SAWTEE) and ActionAid Nepal.Chandan Sapkota, a regular newspaper commentator on trade and economic issues, says: "It was known two decades ago that all quotas in this sector would be abolished. There was ample time to invest and restructure the Nepali garment industry. However, both investors and policymakers turned a blind eye to the necessity for the reorganisation of this industry."The phasing out of quotas and the country’s inability to prepare itself for a level-playing field has been devastating. While there were 212 manufacturing units in 2000/2001 manufacturing RMG for markets primarily in the United States, EU, Japan and Canada, now only a handful of units remain.

In the goal, by emphasizing on dignified and gainful employment, reduction of economic disparity and abolition of social deprivation aims at reducing poverty to 21 percent by the end of TYP from present level of 25.4 percent. It adds that by means of improved living conditions through sustainable growth, this will be possible.To begin with, the targets of 21 percent based on new poverty estimates of 25.4 percent are highly questionable, which are simply based on income poverty elasticity that comes out at 0.25 based on a historical data.If this could have been the case, during 1985-90 and 1992-97, poverty would have reduced drastically as the growth rate was above 4.8 percent at that time. But 1996 and 2004 survey data show that poverty remained at 42 percent throughout this period.Despite so much propaganda on dignified or gainful employment in the approach paper, employment calculation is also simply based on historical employment elasticity of 0.60.The method to calculate the investment requirement and techniques used to fix sectoral resource allocation pattern, including bifurcation between the government and private sector, are highly questionable. The fixation of plan outlay technique is the same as the first plan. Given the fixed sectoral target and calculated incremental capital output ratio again based on questionable investment and accumulated capital data, the investment requirement has been derived. It, as obvious, cannot address distributional and sustainable growth issues.

In developing countries, identifying the poor for redistribution or social insurance is challenging because the government lacks information about people’s incomes. This paper reports the results of a field experiment conducted in 640 Indonesian villages that investigated two main approaches to solving this problem: proxy-means tests, where a census of hard-to-hide assets is used to predict consumption, and community-based targeting, where villagers rank everyone on a scale from richest to poorest. When poverty is defined using per-capita expenditure and the common PPP$2 per day threshold, we find that community-based targeting performs worse in identifying the poor than proxy-means tests, particularly near the threshold. This worse performance does not appear to be due to elite capture. Instead, communities appear to be using a different concept of poverty: the results of community-based methods are more correlated with how individual community members rank each other and with villagers’ self-assessments of their own status than per-capita expenditure. Consistent with this, the community-based methods result in higher satisfaction with beneficiary lists and the targeting process.

Book review published in The Kathmandu Post

There is a pattern to everything

Have you ever wondered why hundreds of thousands of people join protests and participate in riots? Or, why ordinary people plunge headlong into collective madness (ethnic cleansing, ethnocentric violence, and vandalism)? Also, why do some societies achieve results that others envy of (such as in 1991 Kerala became the world’s only 100 percent literate state)? Why human beings act in the way they do, i.e. they cooperate but at the same time fight with each other; they assume rationality but act based on pure instincts; and they adapt to different situations and imitate others.

To comprehend this range of confounding issues Mark Buchanan uses tools and insights from physics, economics and other social sciences in his book The Social Atom: Why the Rich Get Richer, Cheaters Get Caught, And Your Neighbor Usually Looks Like You. It is about what Buchanan calls “social physics”, which basically is social science along the lines of physics, i.e. trying to find mathematical regularities in social life. One of the core themes of the book is that there is a pattern to everything that happens in nature.

tools and insights from physics, economics and other social sciences in his book The Social Atom: Why the Rich Get Richer, Cheaters Get Caught, And Your Neighbor Usually Looks Like You. It is about what Buchanan calls “social physics”, which basically is social science along the lines of physics, i.e. trying to find mathematical regularities in social life. One of the core themes of the book is that there is a pattern to everything that happens in nature.

By viewing humans as “social atom”, Buchanan, a theoretical physicist and former editor of Nature and New Scientist, offers an enriching and stimulating discussion of events ranging from literacy campaigns in Kerala to sudden riots in the most unexpected regions of the world to natural segregation of societies along racial and ethnic lines to genocide in Rwanda.

The message directed at social scientists is simple: Understanding human behaviour might seem a daunting, complex task but, like in physics, if we go to the most simplest unit—treating each human being as atom, thus social atom—then it might not be as complex as it sounds. Complexity is rooted in simplicity.

He argues that by looking at patterns behind the origin and functioning of both usual and unusual events, social scientists can discover mathematical laws like the ones we find in physics. No wonder, the failure to look at patterns might have resulted in a lack of laws in economics and social sciences. This is not the case in pure sciences such as physics, chemistry and biology. By flatly assuming that people are self-interested and that they make rational decisions, the mainstream economists ignore the fact the human beings are a part of the nature and there is a pattern on how they learn, act and behave. In fact, human beings are not rational calculating machines, but biological pattern recognisers who are able learn from their mistakes.

He advises the mainstream economists to think of people as if they were atoms or molecules following simple rules in society. Failure to do this is clearly visible in economics: even the most sophisticated economic theory lacks the kind of understanding found in pure sciences. Humans are not rational calculators, but crafty gamblers. They are skilled at recognising patterns and adapting to changing world. Sadly, most of the economists have failed to recognise this simple behavioural pattern.

Interestingly, our collective behaviour follows mathematical patters of surprising precision. He argues that the most common one of them is power law. It emerges “naturally in systems that are decidedly not in equilibrium.”

The book is filled with enriching discussion about the occurrence of power law in the distribution of wealth and inequality, power and politics, class hatred, racial segregation, fads, fashion, riots, spontaneous outbreaks of goodwill and hatred within communities and financial markets.

There are three kinds of social atoms: (i) adaptive atom, (ii) imitating atom, and (iii) cooperative atom. Human beings are adaptive rule followers, not rational automations. The rationality assumption incorrectly presupposes that people do not learn, form hypotheses and tests, and change their decisions frequently.

People are fundamentally adaptive and their decision accords with reality, even if their choice might look irrational to economists. People have to make decisions in an uncertain and ever-changing setting of markets. Their decision, however irrational it may look like, comes from adaptive behaviour, i.e. they make mistakes, rectify their actions, and adapt to changing environment. It is not unusual that large movements in the market seem to take place in the absence of any big event, he argues.

In addition to being adaptive, we are also born imitators. Imitation does not generate any new information but it amplifies the consequences that a little bit of information can have. Coming back to the point of public protesting and rioting, it is by constant interaction and imitation that hundreds and thousands of protesters and rioters take on to the streets, irrespective of their awareness of the main causes of riots and strikes. This behaviour of social atoms is usually ignored by economists. Buchanan argues that what gets a riot going at the outset isn’t necessarily the same as what keeps it going or determines how big it eventually gets.

The decision of the first person to join riot might be his own but after 50 people start smashing things up, the decision for 51st to join the riot is completely different. It is not “nearly so hard to join in when everyone you know is doing it.” The imitative behaviour of Kerala resident in achieving high levels of education has made it one of the most literate states in the world.

Next comes the cooperative atom, who is an altruist defying the assumption of self-interested agents. Humans are not as self-interested and greedy as economic theorists assume. This has been well documented by game theorists and behavioural economists. The assumption of self-interested agents fails to account for selfless actions that millions of people undertake every day without any strategic hope of future reward. Many of us are “biologically predisposed to such altruistic acts.”

With a combination of adaptive, imitative and cooperative behaviours, human beings are equally skilled at making peace for the same reasons that they are skilled at making war. Even blind prejudice helps people to cooperate and participate in things that are usually not expected of them. This is why ethnocentric movements have large number of participants cooperating with each other even in the face of incomplete or manipulated information.

Repeated interactions between people of opposing ideals and values, and the imposition of effective social norms help to keep ethnocentrism at bay. May be this is what we need to defuse the tense crisis in Nepal right now!

The crux of the book is that social scientists need to view human beings as atoms and molecules following fairly simple rules, that there is a pattern to everything, and that even oversimplified models can go a long way “if social scientists can get right the few details that really matter.”

Perhaps economists need to pay more attention to realistic assumptions, simplify their models to reflect reality rather than to fit elegant mathematical models, and view human interactions as complex but having some pattern to it.

[Published in The Kathmandu Post, May 15, 2010, pp.7]

So, the Nepalese government finally decided to endorse a new industrial policy, which replaces the old one of 1992.

Check out this blog post for details.

The new industrial policy would mean little if there is no political stability and policy consistency. Political stability has been the most binding constraint on economic growth and industrial activity in Nepal. Also, the sad truth is that policies are formulated but hardly implemented. We have to see how far the policies will be implemented in reality in the days ahead. But, for now, formulating a new, updated industrial policy is a good progress in an economy where pretty much everything variable seems to be in doldrums.

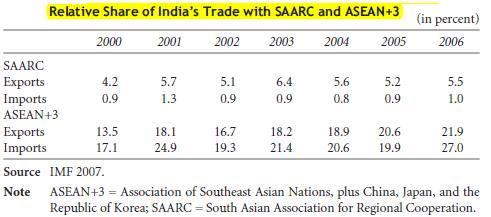

This is just a summary/note of the status of South Asian Free Trade Agreement (SAFTA). It is heavily extracted from Weerakon’s chapter in this book published by the WB. I will post updated analysis and figures later. It walks through the events leading to SAFTA (from the establishment of SAARC and the passage of SAPTA). The one thing that stands out is that the role of India in stimulating trade in the SAARC region.

Most of the SAARC nations heavily depend on the Indian market for trade. Meanwhile, in terms of trade volume, India trades the least with SAARC nations. So, SAARC nations need India to liberalize its trade regime further, not the other way round! It is time for other SAARC nations to reciprocate India. I still need to get hold of a good paper that weighs the gains and losses to each SAARC nation from SAFTA.

---------------------->>

In 1977, Sri Lanka initiated the process of policy liberalization and other countries followed in the 1980s. A regional bloc named South Asian Association for Regional Cooperation (SAARC) was established in 1985.

India liberalized in early 1990s, leading to a wave of economic liberalization in South Asia. To be fair, without India’s initiation, no trade agreement under SAARC would be possible. SAARC countries rely heavily in the Indian market for both exports and imports. However, this is not the case with India, which trades more with ASEAN, the EU and the US.

A proposal to initiate SAPTA was agreed upon by SAARC members in December 1995. The next year, they agreed to start SAFTA by 2000 (but not later than 2005). With good progress in SAPTA by 1998, the SAARC nations proponed the initiation date of SAFTA to 2000.

Unfortunately, the initiative dealt a blow due to rising political tension between India and Pakistan. The SAFTA framework was only adopted in 2004 after political tension cooled between the two countries. To be fair, progress in the SAARC blog has been a victim of bitter animosity and untrustworthy environment between India and Pakistan.

Outstanding issues liked to rules of origin (ROO), sensitive lists and other concerns were sorted out in January 2006. Under the proposed Tariff Liberalization Program (TLP), SAFTA will become fully effective for LDCs (Nepal and Afghanistan) by 2016 and for non-LDCs by 2013.

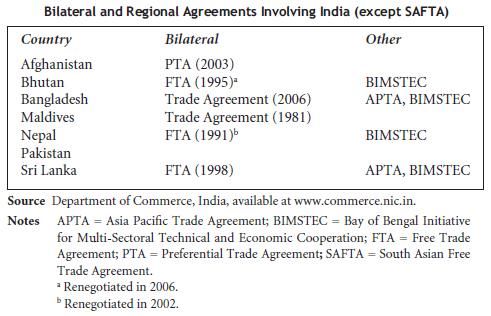

There are legitimate concerns about the usefulness of SAFTA because of the number of goods in sensitive list, ROO conditions, and other preferential access through bilateral FTAs that will offer more generous tariff cuts and market access than SAFTA does. Moreover, there are arguments that regional integration would not be that effective because there is hardly any potential for comparative advantage-driven trade because most of the countries share similar socio-economic fundamentals such as low income, abundant labor, language in general, etc. Others echo the view that countries are better off if they liberalize trade unilaterally (this works only if India leads and it benefits other SAARC nations). Some (here and here) argue that regional trade integration will in fact yield a net welfare loss and slow unilateral liberalization. However, new studies have identified benefits not only in trade in goods but also in services and investment.

SAPTA did not move far enough because of various self-imposed trade constraints.The most limiting factor of SAPTA was the scope of goods protected under special lists. For instance, products imported from under SAPTA concessions translated to only 15 percent of total imports between SAARC nations. Intra-SAARC trade was just 5 percent of total trade with the rest of the world.

Meanwhile, SAFTA adopted a negative list and sensitive list rather than goods covered under preferential concessions. Under SAFTA, non-LDC members are required to reduce existing tariff to 20 percent within two years of implementation of the agreement. Then, in the next five years, they are required to reduce tariffs to a range of 0-5 percent. For LDCs, in the first two years, tariffs should come down to 30 percent and to 0-5 percent in the next eight years. The LDCs are in a better position in terms of reducing tariff. Note that the tariffs reduction under SAFTA still fall short of the concessions under some of the bilateral trade agreements among SAARC nations, mainly with India.

With regards to rules of origin (ROO)- which generally includes provisions to prevent trade deflection, facilitate value addition, and augment the volume of intraregional trade- SAFTA ROO is similar to that under the bilateral FTAs in the region.

Regarding sensitive list, which is used to shield sensitive industries from increased competition, there are a lot of items that do not face competition, i.e. tariffs are not brought down. In general, countries retain a negative list of 20 percent of tariff lines for non-LDC nations. Nepal maintains the highest number of items under sensitive list. There is no formal and binding provision in the framework agreement requiring that negative lists are pruned down over time. This is in contrast to other FTAs, which require explicitly that negative lists be phased out with time.

Almost 53 percent of total import trade among South Asian nations by value is excluded from the liberalization of tariffs proposed under the SAFTA treaty. India is taking an unilateral move to prune its sensitive list by removing an additional 264 items applicable to LDCs. There is also no explicit commitment to deal with nontariff barriers.

SAFTA is confined to trade in goods, leaving trade in services, investment and other areas of economic cooperation. Moreover, the required initial tariff liberalization of 20 percent threshold is not that encouraging because most of the nations have been unilaterally lowering Most Favored Nations (MFN) tariffs quite substantially over time.

More than 90 percent of regional trade for Nepal, Bangladesh, Sri Lanka is confined to a bilateral relationship with India. Basically, the process of creating SAFTA involves market access between India and other South Asian economies. India is the biggest consumer of other SAARC nations’ exports. If India gives generous concessions, then the trading partner benefits tremendously. For instance, Nepal and Sri Lanka benefit from trading with India. Nepal’s share of trade with India in total intra-SAARC trade is almost 100 percent, while in total world trade, Nepal’s trade with India is close to 70 percent.

The SAARC nations need India to open up its markets and give more concessions, not the other way round. In fact, India’s share of imports from SAARC nations is close to one percent, which is less than its imports from ASEAN+3 nations (27 percent).

Nepal’s trade with India is increasing rapidly while its trade share with ASEAN+3 is decreasing. India is becoming the most valued market for Nepali exports. The more concessions India gives, the more will be Nepal’s trade with India.

At present, most South Asian nations are restricting 55-65 percent of their imports from India under SAFTA sensitive lists.

Almost all the countries have signed either bilateral or regional (or both) trade agreements involving India.

Tarun Khanna and Santiago Mingo argue that the green industrial policy of Brazil worked.

What did they do?

Brazil’s experience at promoting renewable fuels, beginning in the 1970’s, is directly relevant to today’s polarized views of industrial policy. A 10-year industrial policy program called Pro-álcool was crucial in the development of the industry. Today, Brazil is the world’s most competitive producer of renewable fuels, based primarily on bioethanol. Ethanol accounts for more than 50% of current light-vehicle fuel demand in the country, and Petrobras – Brazil’s energy giant and one of the largest companies in Latin America – expects this share to increase to more than 80% by 2020.

Our research shows that industrial policy was successful in promoting a competitive bioethanol industry in Brazil. A massive stimulus package, prompted by the 1970’s rise in oil prices, gave rise to an entirely new industry. But it would not have worked without the crucial role played by competition.

How did they do?

As world energy prices collapsed, Brazil fortuitously turned off its subsidy tap, whereupon a

brutal Darwinian free-for-all ensued. This competitive rationalization was the key to the policy’s success.

The Brazilian state offered low-interest loans and credit guarantees for the construction of distilleries, as well as tax incentives for the purchase of ethanol-powered vehicles. Ethanol prices were manipulated to make it an attractive alternative to gasoline. In addition, the government induced Petrobras to distribute the renewable fuel. Gas stations installed ethanol pumps. The government signed agreements with the major automobile companies to provide incentives to make vehicles that could run on 100% ethanol.

By the 1990’s, the major subsidies and policies were abolished, and the industry was deregulated. Our statistical analysis of the entry and exit patterns of entrepreneurs in the Brazilian ethanol industry shows that the more efficient acquired the less efficient. Most underperforming ethanol companies went bankrupt or were taken over by entrepreneurs who had successful track records in running efficient operations.

The government did not bail out the underperformers, allowing market forces to restructure the industry during the post-subsidy phase. Certainly, the beneficiaries of Pro-álcool’s subsidies lobbied the state to continue the protective policies even after their usefulness – inducing the development of the industry – had expired. Fortunately, the government was not persuaded.

Lessons from Brazilian IP exercise:

Brazil’s experience offers three important lessons for nations implementing renewable energy initiatives: (1) government policies must be consistent, simple, and long-lasting, providing assurance to would-be entrepreneurs that they can invest for the long haul; (2) picking winners, the familiar weakness of overenthusiastic bureaucrats, must be kept to a minimum; and (3) the state must have the discipline to dismantle subsidies when the need for them has passed.

Ravi Kanbur echoes what a lot of development professionals working on the ground in developing countries have been saying for a long time.

Each poverty professional should engage in an “exposure” to poverty (also known as “immersions”) every 12 to 18 months. I do not mean by this rural sector missions for aid agency officials, nor the running of training workshops by NGO staff. What I mean is well captured by Eyben (2004); these are exercises that “are designed for visitors to stay for a period of several days, living with their hosts as participants, as well as observers, in their daily lives. They are distinct from project monitoring or highly structured ‘red carpet’ trips when officials make brief visits to a village or an urban slum….

----

What is striking about the class of poverty professionals (of whom I am one) is that the good living (granted, not at the billionaire or millionaire level, but pretty good nevertheless) is made through the very process of analyzing, writing, recommending on poverty. To me, at least, this is discomforting and disconcerting

----

I recall many years ago, when I was in my twenties, telling the anthropologist Mary Douglas about how I was starting to do consulting for the World Bank on poverty issues, and how important it was to do this work. “And it’s not too bad for one’s own poverty either, is it?” came her worldly, knowing, reply. The seeds of discomfort sown by that comment have germinated and taken root, and now won’t let go.

Perception of poverty matter. What is troubling is that researchers who have never lived a life of a poor person (for simplicity, discount the opportunity cost of what Collier says "hope") brand people living in developing country as "poor" when the "poor" don't feel that s/he is really "poor".

Eligibility: Any person who is above the age of 18 and resides in rural areas is entitled to apply for work.

Entitlement: Any applicant is entitled to work within 15 days, for as many as he/she has applied, subject to a limit of 100 days per household per year.

Distance: Work is to be provided within a radius of 5 kilometers of the applicant’s residence if possible, and in any case within the Block. If work is provided beyond 5 kilometers, travel allowances have to be paid.

Wages: Workers are entitled to the statutory minimum wage applicable to agricultural laborers in the state, unless and until the Central Government “notifies” a different wage rate. If the Central Government notifies, the wage rate is subject to a minimum of Rs.60 per day.

Timely payment: Workers are to be paid weekly, or in any case not later than a fortnight. Payment of wages is to be made directly to the person concerned in the presence of independent persons of the community on pre-announced dates.

Unemployment allowance: If work is not provided within 15 days, applicants are entitled to an unemployment allowance: one third of the wage rate for the first thirty days, and one half thereafter.

Worksite facilities: Laborers are entitled to various facilities at the worksite such as clean drinking water, shade for periods of rest, emergency health care, and crèche.

Employment guarantee scheme: Each State Government has to put in place an “Employment Guarantee Scheme” within six months of the Act coming into force.

Permissible works: A list of permissible works is given in Schedule I of the Act. These are concerned mainly with water conservation, minor irrigation, land development, rural roads, etc. However, the Schedule also allows “any other work which may be notified by the Central Government in consultation with the State Government.”

Program Officer: The Rural Employment Guarantee Scheme is to be coordinated at the Block level by a “Program Officer”.

Implementing agencies: Works are to be executed by “implementing agencies”. These include, first and foremost, the Gram Panchayats (they are supposed to implement half of the works), but implementing agencies may also include other Panchayati Raj Institutions, line departments such as the Public Works Department or Forest Department, and NGOs.

Contractors: Private contractors are banned.

Decentralized planning: A shelf of projects is to be maintained by the Program Officer, based on proposals from the implementing agencies. Each Gram Panchayat is also supposed to prepare a shelf of works based on the recommendations of the Gram Sabha.

Transparency and accountability: The Act includes various provisions for transparency and accountability, such as regular social audits by the Gram Sabhas, mandatory disclosure of muster rolls, public accessibility of all documents, regular updating of job cards, etc.

Participation of women: Priority is to be given to women in the allocation of work, “in such a way that at least one-third of the beneficiaries shall be women”.

Penalties: The Act states that “whoever contravenes the provisions of this Act shall on conviction be liable to a fine which may extend to one thousand rupees”.

State council: The implementation of the Act is to be monitored by a “State Employment Guarantee Council.”

Cost sharing: The Central Government has to pay for unskilled labor wages and 75% of the material and semi-skilled, skilled labor wages. State governments have to pay the 25% of the material costs and unemployment allowance, if liable.

The recent financial crisis has reignited debate on capital controls. Before the crisis, most financial institutions believed government control of the inflows of capital was bad for a nation’s economy and credit rating. During the crisis, however, several countries, including Brazil, Colombia, Thailand and Malaysia among others, imposed capital controls that helped reduce economic volatility. This has cleared the stigma that capital controls are bad for the economy, according to a distinguished panel of experts hosted by Carnegie.

Marcos Chamon, an economist at the IMF, highlighted the findings of a recent IMF Staff Position Note on controls in capital inflows and Jorge Arbache, a senior economic adviser to the president of the Brazilian Development Bank, and Boston University’s Kevin Gallagher discussed the policy space available to developing countries for imposing capital controls. Carnegie’s Eduardo Zepeda moderated.

Capital inflows are fundamentally positive when there is a general need for additional financing for productive investment and risk diversification, explained Chamon. However, when there are sudden and temporary surges that could potentially increase macroeconomic volatility, capital controls can be valuable tools.

During the crisis, net capital flows into emerging markets dropped by more than US$ 200 billion between the third and fourth quarters of 2008. Capital controls could help manage that kind of economic volatility:

Conditions for controls: Chamon added that capital controls might be appropriate when:

Policies to prevent and mitigate financial crises are forbidden in large parts of the trade regime. The panelists suggested that there should be exceptions for capital controls in trade and investment treaties between countries.

Brazil imposed several capital control measures, including taxes on capital account transactions and on fixed-income and equity inflows. Arbache argued that a more vigorous capital control is needed as a short-term policy option. The Brazilian economy is facing a number of pressing problems, which might require capital controls combined with structural policies for fiscal reform, including:

Capital controls might be suitable for curbing sudden short term capital flows, Gallagher offered. They could be one of several tools used to stem financial market instability. In such a case, capital controls should be a coordinated effort among a majority of the central banks, concluded Gallagher.

[Source: This summary is adapted from an event on capital control organized at Carnegie Endowment. Yours truly wrote the event summary for TED program.] Click here, here and here for the speaker’s presentation.

My latest piece is about the economic costs of the Maoist-imposed strike in Nepal. Yesterday, due to public and diplomatic pressure, the Maoist party ‘postponed’ the conflict (as if imposing strike is their property right!). My point is simple: if the parties continue with strikes, then the Nepali economy will collapse. Here and here are my previous costs estimate of bandas.

-------------

Definite economic meltdown with indefinite bandas

Pretty much everything is in a standstill since May 1. The UCPN-Maoist has imposed an indefinite strike to topple the government. In a nation of over twenty-eight million people, few hundred of thousands of supporters, both willing and reluctant, are bused into cities, including Kathmandu, to show discontent over the ruling of the existing government.

This is battering the ailing economy hard. The political leaders need to understand that there will be no peace and the constitution would mean very little if there is an economic tsunami.

A dysfunctional economy will inflict more pain than the political upheavals we have been witnessing since 1996. Without urgent remedial policies for the collapsing economy, no matter who and which party runs the government, the situation will only get bad. Most of the causes of and remedies for the collapsing economy can be traced back to an unstable political climate and persistent strikes. More on this in a minute.

First, lets be clear about the deteriorating macroeconomic situation. The official inflation rate has been hovering around 12 percent and is not expected to come down anytime soon if supply-side constraints persist. For the first time in more than three decades, the balance of payments (BOP) is in deficit, reaching Rs 23.53 billion in the first eight months of this fiscal year against a surplus of Rs 32.58 billion in the same period last fiscal year. This is primarily caused by a decline in the growth of remittances and a soaring trade deficit. Bandas and political instability are two of the main factors causing soaring trade deficit.

Trade deficit reached Rs 206.07 billion, a 62.9 percent growth against 29.5 percent growth in the first eight months of last fiscal year. Exports declined by 8 percent while imports surged by 43.9 percent. Meantime, remittances reached Rs. 146.93 billion, a 9.9 percent growth as compared to 58.9 percent growth last year. The rapid rise in trade deficit is drawing down official reserves, which is sufficient to fund only 6.6 months of merchandise and service imports. We used to have reserve enough to fund nine months of imports. Worse, current account deficit (% of GDP) is expected to be in the negative territory and GDP growth rate to stagnate around 4 percent for at least until 2015, according to the IMF's estimate.

On top of this, there is liquidity crunch in the market. Recently, we experienced a severe shortage of domestic currency. The Indian rupee is gradually becoming a favored currency option due to loss of confidence in the Nepali rupee. While the housing sector is bubbling, other productive sectors are suffocating with a lack of liquidity. The central bank has already injected net liquidity of Rs 69.1 billion so far this year. The commercial banks are jacking up interest rates, making it harder for investors to withdraw money and serve interest payments. Despite high interest rate, deposit growth is lower than last year's. The inter bank lending rate increased by 8.85 percent from 6.38 percent. This means that even banks are wary of lending to each other. Most of the variables are progressively getting bad. Much worse is yet to come, if the current political instability, strikes, bandas, and economic stalemate persist.

How does this affect an ordinary citizen? Well, the worse these variables get, the precarious the situation will become because markets will lose confidence in the economy. It will result in closure of many factories. Unemployment rate, which is around 46 percent, will increase as firm will lay off workers and freeze hiring. Worse, would-be entrepreneurs will withhold investment. With a deteriorating situation, foreigners will pull out their investment from sectors ranging from consumer goods to hydropower. Importers will also lose confidence in the ability of domestic firms to supply goods in time, leading to cancellation of orders as was done by the Wal Mart and Gap Inc at the height of the last revolution. The need for social safety nets will increase and livelihood of many rural people will perish as intermediate buyers quit markets. Ultimately, the most vulnerable people will be hit by the strongest tides of the tsunami. The poor will be the ultimate losers. The politicians will be the last one to get hit, if they do.

In terms of costs to the economy, in a worst-case scenario, a back-of-the-envelope estimation of the costs of bandas shows that per banda day the economy bleeds 88 percent of the total value of goods and services produced in a day. This one shot, standalone estimation also shows that the industrial sector would suffer Rs 346 million per day. An average Nepali citizen of working age population would lose Rs 117 per banda day.

The crux of this mess lies in political instability and bandas. There is already a vicious strike-unemployment cycle in the economy. In terms of GDP per capita, we are the poorest nation in Asia. Frequent and fickle bandas will make us even poorer. In a country that has approximately 70% of the population live below $1.25 a day and has high population growth rate, income per capital will only go down and poverty will only increase.The most unfortunate situation is that even though we have money (budget surplus of Rs 4.40 billion in the first eight months of FY2009-10) to spend, we are not being able to do so due to politically-induced disruptive activities even at local level.

The UCPN(M) should take some responsibility for the deteriorating macroeconomic situation. The economically destructive activities of YCL; incessant pressure exerted by militant labor unions on the weak industrial sector; forced donation campaign tantamount to illegal tax collection; deliberately inflicting troubles in firms operated by foreign companies; disruption of supply lines; and a threat to life and property of entrepreneurs are the infamous activities mostly associated with the largest party in the parliament.

If they are returning to power, then they will have to explain to the citizens how they are going to rescue Nepal from the impending economic tsunami. The CPN(M) have not uttered a single word about their economic policy to ward off the grave challenges confronted by our economy.

Dahal and Bhattarai must explain, in plain terms, at least their strategy to salvage the economy; to revive the industrial sector; to return back illegally confiscated property; to provide employment to thousands of indoctrinated and duped YCL cadres who have been promised jobs and other opportunities; to provide safety nets to the laid off workers from the industrial sector; to rehabilitate its indoctrinated supporters; to address starvation in the Western region; and to reduce poverty. They need to realize that people did not join CPN-Maoist because of their belief in the failed Marxist-Leninist doctrines, but because of poverty and state apathy in instituting an inclusive society. These cannot be addressed by imposing bandas and by trying to topple the government with pernicious political strategy.

[Published in Republica, May 6, 2010, pp.7]

The past 180 years offer a smorgasbord of financial crises to study. They include:

The financial crises shares the following common themes:

Source: This time is different: Eight centuries of financial folly