I seem a little bit harsh on the Maoist party and its leaders in my latest op-ed. I am not taking sides and won’t do it. This column is not political; it is based on what the data shows and what I think explains the trend in trade deficit with India. I avoid politics as my domain is economics and economic policy.

To be fair, I see YCL's and the unions' disruptive activities as nothing but a problem for the industrial sector. I don't care what they do in other sectors and in politics, but browbeating the investors and chasing away multinationals would do no good to the Nepalese economy. The industrial sector is bleeding, hence the high trade deficit, because of the militant activities in and around production sites, where production should take place, not destruction. I am clarifying this because I have received several emails saying that I have been particularly biased against and harsh towards the Maoists. Well, I am not. I have written articles supporting the Maoists government’s economic policy and have also criticized not only their’s, but also other party’s policies.

----------------------------------------------------------------------------

CHANDAN SAPKOTA

Recently, Maoist Chairman Pushpa Kamal Dahal laid out five agendas for talks with India. Two of them are related to trade. He wants trade deficit with India to be “corrected” and “prompt strategy” taken to help Nepal gain from the growth of the two giants economies between which she is ‘sandwiched’. (By the way, was that also a “satire”?)

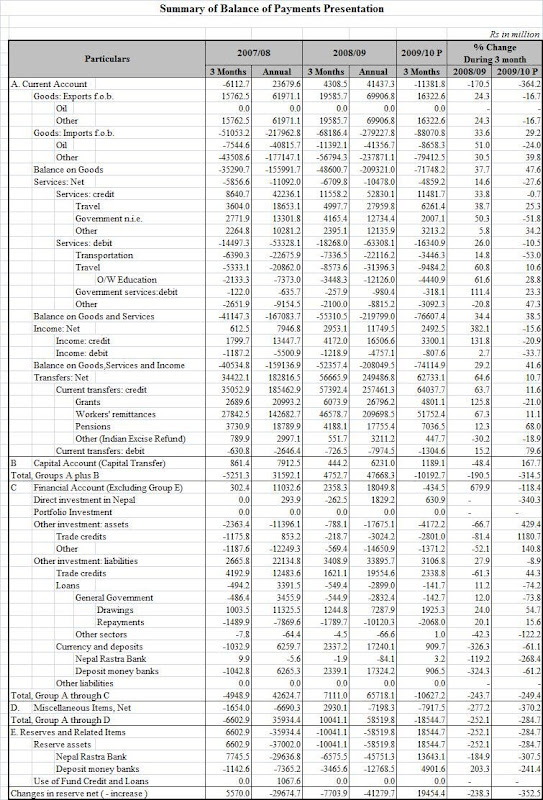

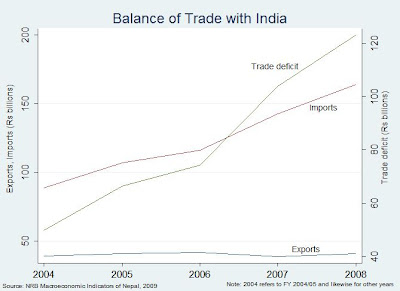

High trade deficit with India is not a new phenomenon at all. It has been increasing in line with our excessive dependence on the Indian economy. What is surprising this time around is that the balance of trade – the monetary value of exports minus imports of output over a certain period of time – with India has increased dramatically (see the figures). This is alarming because a high trade deficit and an unfavorable balance of payments situation signals troubles in an economy—especially its capacity to ensure exchange rate and macroeconomic stability, and to sustain imports levels to support rising domestic demand for foreign goods and services.

Total trade deficit with India in the first quarter of this fiscal year was Rs 38.9 billion, a 38.8 percent increase from the same period last year. Total exports to India decreased by 11.4 percent and total imports increased by 25.2 percent in the same period. Overall, total trade deficit is increasing rapidly since the Maoists intensified their insurgency at the beginning of this decade. The rate of increase of trade deficit has been especially high after the Maoists joined the government and started messing up with the industrial sector with demands that are inconsistent with the present state of our economy.

--------------------------------------------------------------------

Rather than blaming India for increasing trade deficit, Dahal needs to do some soul-searching to realize to what extent his party has contributed to the demise of the manufacturing sector, export-oriented production, and export potentials.

---------------------------------------------------------------------------

There is consensus among policymakers and analysts that the rising trade deficit is unsustainable. It needs to be rebalanced. But, how? Dahal pointed his finger towards India and indirectly blamed her for increasing Nepal’s trade deficit. Either he does not comprehend what causes trade deficit and our inability to benefit from the booming economies of neighbors or he is blaming India to arouse unnecessary nationalistic feeling to consolidate party and voter base.

A high trade deficit is caused when the total monetary value of exports is lower than the total monetary value of imports. This is exactly what is happening right now. The share of and monetary value of imports from India are higher than exports to India. Is this India’s fault, like Dahal is hinting, or are we too dependent on the Indian economy for daily needs? Undoubtedly, whatever Dahal says, the latter is the case.

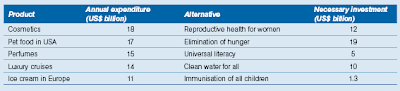

What are the factors that are causing high imports and low exports? At a time when the economy is stagnating, high imports from India are primarily driven by high demand arising from increasing remittances. The inability to utilize remittances in productive investment at home, except for producing bubbles in real estate and housing markets, is a prime factor for diversion of remittance money to India.

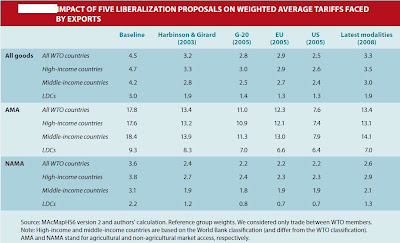

In principle, the government could raise tariffs and impose non-tariff barriers to slowdown imports from India. However, this might be counterproductive because the problem here is not oversupply from India; it is excess demand of Indian goods and services by Nepali consumers. An increase of tariffs on agricultural goods, of which domestic demand is higher than domestic supply, would be devastating as it poses a real danger of flaring up general prices.

Meanwhile, a marginal increase of tariff on non-agricultural goods would not be effective because middle-class consumers would effortlessly adjust consumption pattern to suit their fascination for non-agricultural goods and services imported from India. Additionally, there is nothing the government can do to decrease oil imports from India because the demand is going to be far greater as power shortage escalates in coming days. So, in terms of slowing down imports, there is little room left for policy maneuver that would be independent of general prices.

The only way we can ‘correct’ trade balance with India is to increase exports. India has already opened up its market for most of the goods exported by Nepal. Unfortunately, Nepal has failed to take advantage of the opportunities. Whose fault is it? Going by Dahal’s interpretation, it is India’s fault! Quite contrary to his misguided opinion, it is primarily the Maoists’ fault.

Allow me to explain how. Think of the major constraints on exports to India: An increase in cost of production in the domestic market; a decline in total production of goods and services; and the inability to deliver goods on time.

First, the pressure to increase wages and allowances, lack of regular supply of electricity and increasing strikes in and around industrial complexes have shot up cost of production, making Nepali goods and services relatively uncompetitive in the Indian market.

Second, persistent strikes demanding for life-long permanent employment status irrespective of labor productivity and efficiency, and forced closure of firms have compelled investors to involuntarily shut down factories. Not only domestic firms but multinational firms have stopped production due to stupid, business-unfriendly drama orchestrated by militant Maoist-affiliated trade unions and YCL cadres. This has led to decrease in manufacturing activities, total production, and employment.

Third, due to numerous transportation strikes and insecurity along the main trade routes, delivery of goods to the Indian market have been severely hampered, leading to a loss of faith and demand from Indian clients.

In each of the three constraints outlined here, the Maoist- affiliated sister organizations have played a crucial role in strengthening them, thus costing the nation billion of rupees in export revenues. This has resulted in low monetary value of total exports and widening of trade deficit.

Rather than blaming India for increasing trade deficit, Dahal needs to do some soul-searching to realize to what extent his party has contributed to the demise of the manufacturing sector, export-oriented production, and export potentials. It is essentially Dahal’s trade deficit!

[Published in Republica, December 29, 2009, pp4; http://bit.ly/6ZfTSf]