There has been quite a buzz about global financial crisis and protectionism. Some economists and analysts fear that recent event could lead to more red tapes in international trade and globalization. This has also ignited debate on industrial policy and if this is good or bad.

Easterly termed Rodrik as “the intellectual protector of protectionist” for consistently doubting the promised benefits of trade (assault on the Washington Consensus) and favoring some form of state intervention to solve co-ordination externalities and promote ‘self-discovery’.

Green pours in thoughts (in favor of Rodrik):

‘As economies developed and became more complex, and industries achieved international competitiveness, the costs and benefits of state intervention in both agriculture and industry shifted, and governments started to reduce their role and open up the economy. Exactly the same sequence had previously been adopted by rich countries at an earlier stage of development. Deregulation and liberalisation are thus better seen as the outcomes of successful development, rather than as initial conditions.'

In other words, it is not double standards, but history that leads to the argument that protectionism makes more sense in developing countries than in rich ones. This was the historical basis for the growing emphasis by developing countries on the need to retain ‘policy space’ in trade and investment agreements.

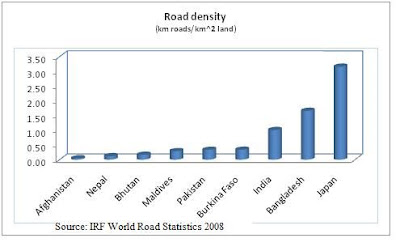

Sequencing of reforms is extermely important and the same set of reforms successful in one country might not be effective in another. Also, how can one forget the role played by MITI during Japan’s take off. State intervention aimed at taking care of coordination failures and information externalities does work in the process of development. This is not about whether state intervention is good or bad- it is about if it works in some countries, especially the developing ones. The application of the same set of policies (under the Washington Consensus) in Sub-Saharan Africa have left them in a bad shape than they were before!

This reminds me these paragraphs from Stiglitz’s book Frontiers of Development Economics:

Market-enhancing can take many forms- from indirect rule-making that affects incentives, to direct government interventions that structure markets...The general principle is that government action can facilitate private sector coordination and provide the necessary incentives to the private sector by creating “contingent rents”- returns in excess of the competitive market, provided certain conditions are fulfilled (as for patents or export subsidies based on targets) (pp34-35).

The sequencing of reforms- that is, whether regulatory politics precede or follow privatization-matters. In one sequence, the result may be a competitive or regulated industry, where the benefits of privatization in terms of lower consumer prices are realized. In the other sequence, one may end up with an unregulated monopoly, which, to be sure, may be more efficient than it was as a public sector producer but which may be more efficient not only in producing goods but also in exploiting consumers(pp419).

Here is Rodrik on industrial policy:

Industrial policy an be viewed as a “coordination device” to stimulate socially profitable investments, In particular, the socialization of investment risk through implicit bailout guarantees my be economically beneficial despite the obvious moral hazard risk it poses (pp27).

…a credible, sustained real exchange rate depreciation may constitute the most effective industrial policy there is (pp48).

Strategies that emphasize industrial policy are appropriate when private returns are depressed not by the government’s errors of commission (what it does), but its errors of omission (what it fails to do) (pp84)… Industrial policy will work when private returns are low because of informational and coordination failures (pp95).