Read today's piece by Niall Ferguson, who frets about warlike spending during no-war time (but forgets about the depression economy), in FT:

When Franklin Roosevelt became president in 1933, the deficit was already running at 4.7 per cent of GDP. It rose to a peak of 5.6 per cent in 1934. The federal debt burden [in the United States] rose only slightly – from 40 to 45 per cent of GDP – prior to the outbreak of the second world war. It was the war that saw the US (and all the other combatants) embark on fiscal expansions of the sort we have seen since 2007. So what we are witnessing today has less to do with the 1930s than with the 1940s: it is world war finance without the war.

Those economists, like New York Times columnist Paul Krugman, who liken confidence to an imaginary “fairy” have failed to learn from decades of economic research on expectations. They also seem not to have noticed that the big academic winners of this crisis have been the proponents of behavioural finance, in which the ups and downs of human psychology are the key.

The evidence is very clear from surveys on both sides of the Atlantic. People are nervous of world war-sized deficits when there isn’t a war to justify them. According to a recent poll published in the FT, 45 per cent of Americans “think it likely that their government will be unable to meet its financial commitments within 10 years”. Surveys of business and consumer confidence paint a similar picture of mounting anxiety.

The remedy for such fears must be the kind of policy regime-change Prof Sargent identified 30 years ago, and which the Thatcher and Reagan governments successfully implemented. Then, as today, the choice was not between stimulus and austerity. It was between policies that boost private-sector confidence and those that kill it.

Brad DeLong has a piece that tackles most of the concerns raised by Ferguson:

Here we have the crux: Greece, Ireland, Spain, Portugal and Italy need to be austere. But Germany, Britain, America and Japan do not. With their debts valued by the market at heights I had never thought to see in my lifetime, the best thing they can do to relieve the global depression is to engage in co-ordinated global expansion. Expansionary fiscal, monetary and banking policy, are all called for on a titanic scale. But, the members of the pain caucus say, how will we know when we have reached the limits of expansion? How will we know when we need to stop because the next hundred billion tranche of debt will permanently and irreversibly crack market confidence in dollar or sterling or Deutschmark or yen assets? Will this shrink rather than increase the supply of high-quality financial assets the world market today so wants, and send us spiralling down? Economists had asserted before 1829 that what we call “depressions” were impossible because excess supply of one commodity could be matched by excess demand for another: that if there were unemployed cobblers then there were desperate consumers looking for more seamstresses, and thus that the economy’s problems were never of a shortage of demand but of structural adjustment. But once Mill had pointed out that these economists had forgotten about the financial sector, the way forward was clear – if you could cure the excess demand in the financial sector. Monetarist dogma says the key excess demand in that sector is always for money – and so you can always cure depression by bringing the money supply up. The doctrine of the British economist Sir John Hicks says the key financial excess demand is for bonds, and you can cure the depression by either getting the government to borrow and spend or by raising business confidence so the private sector issues more bonds.

Followers of the US economist Hyman Minsky say the monetarists and the Hicksians (usually called Keynesians, much to the distress of many who actually knew Keynes) are sometimes right but definitely wrong when the chips are as down as they are now. Then the key financial excess demand is for high-quality assets: safe financial places in which you can park your wealth and still be confident it will be there when you return. After a panic, Minsky argued, boosting the money stock would fail.Cash is a high-quality asset, true, but even big proportional boosts to the economy’s cash supply are small potatoes in the total stock of assets and would not do much to satisfy the key financial excess demand. Trying to boost investment would not work either, for there was no excess demand for the risky claims to future wealth that are private bonds. The right cure, his followers argued, was the government as “lender of last resort”: increase the supply of safe assets that the private sector can hold by every means possible: printing cash, creating reserve deposits, printing up high-quality government bonds and then swapping them out into the private market in return for risky assets.

We don’t need one of expansionary monetary and fiscal and banking policy, we need all of them – until further government action begins to crack the status of the US Treasury bond as a safe asset, and further government bond issues reduce the supply of safe high-quality assets in the world economy. Has that day come? No. The US dollar is the world’s reserve currency, the US Treasury bond is the world’s reserve asset. The US has exorbitant privileges that give it freedom of action that others such as Argentina and Greece do not have. Will that day come soon? Probably not.

But trust me, we will know when the time comes to stop expansion. Financial markets will tell us. And not by whispering in a still, small voice.

Brad DeLong has more to say about Ferguson's weak arguments bashing Keynesian economics:

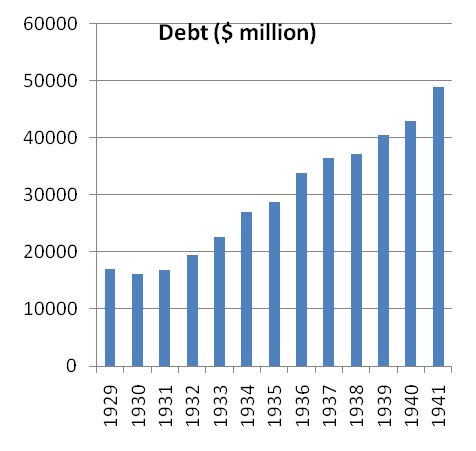

Could we please have some acknowledgement of the fact that the reason the debt-to-GDP ratio did not rise across the 1930s was because GDP rose, not because debt didn't rise? Debt more than doubled from $22.5 billion to $49.0 billion between June 30, 1933 and June 30, 1941. But nominal GDP rose from $56 billion in 1933 to $127 billion in 1941.

And could we please have some acknowledgement that our 9.4% of GDP deficit in fiscal 2010 pales in comparison to the 30.8% of GDP deficit of 1943, or the 23.3% and 22.0% deficits of 1944 and 1945?

Niall Ferguson should not do this. The Financial Times should not enable Niall Ferguson to do this.

Krugman chips in:

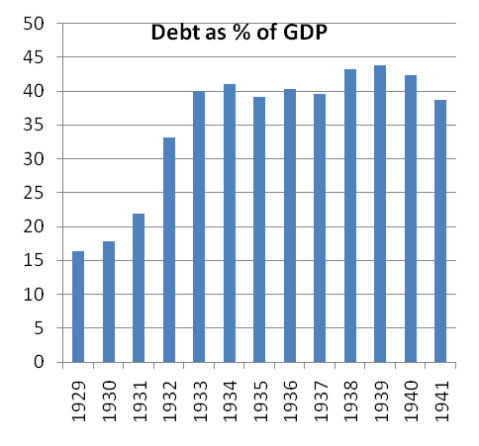

If you were ignorant of basic facts about the Depression — or if you didn’t know that movements in a ratio can reflect changes in the denominator as well as the numerator — you might think that it’s possible to summarize fiscal policy by looking at the federal debt-GDP ratio, which looks like this from 1929-41:Clearly, then, Herbert Hoover was a wild deficit spender, while FDR was much more cautious. Right?OK, we know that’s wrong. Here’s what nominal debt, the numerator in the debt ratio, looks like:So Hoover ran up very little debt — only about 6 percent of 1929 GDP. FDR, on the other hand, ran up a lot of debt, about 47 percent of 1933 GDP. But Hoover presided over a shrinking, deflationary economy, while FDR presided over a rapidly growing (from a low base) economy with rising prices.