This is continuation of the previous blog post about a conference I attended on Friday in D.C. The third panel dealt with current state of global trade relations. The panelists consisted of pretty well known economists and researchers: Kim Elliott, Oliver Griffiths, Gawain Kripke, Will Martin, Christine McDaniel, Devesh Roy, and Steve Suppan. The discussion on the current state of the Doha Round of trade negotiation was pretty stimulating and I was pretty impressed with Roy’s kind of different views on the issues floated by speakers who spoke before him.

First Secretary of the British Embassy at D.C., Oliver Griffiths presented the EU’s views on the Doha Round and made it absolute clear that the EU has given a mandate to its negotiators that the upcoming trade negotiation should not lead to further cuts in agricultural subsidies. Note that agriculture trade accounts for just 10% of global trade but it remains the most contentious issues because a small group of influential farmers are protected in the West at the expense of millions of farmers and farm productivity in the developing countries. Norway and the Netherlands have one of the highest subsides and taxes on agriculture trade. It is worth noting that 63% of the gains from trade will directly go to the developing countries, showing that openness of this sector alone would help the developing countries fight poverty, hunger, and other thorny dimensions of development. Griffiths argued that the EU would like to see further negotiations in three key fields in the future:

First Secretary of the British Embassy at D.C., Oliver Griffiths presented the EU’s views on the Doha Round and made it absolute clear that the EU has given a mandate to its negotiators that the upcoming trade negotiation should not lead to further cuts in agricultural subsidies. Note that agriculture trade accounts for just 10% of global trade but it remains the most contentious issues because a small group of influential farmers are protected in the West at the expense of millions of farmers and farm productivity in the developing countries. Norway and the Netherlands have one of the highest subsides and taxes on agriculture trade. It is worth noting that 63% of the gains from trade will directly go to the developing countries, showing that openness of this sector alone would help the developing countries fight poverty, hunger, and other thorny dimensions of development. Griffiths argued that the EU would like to see further negotiations in three key fields in the future:

-

Future trade negotiation should move from goods to investment and service sector

-

Future trade negotiation should address climate change (tariff on high carbon imports)

-

Trade policies should be coupled with domestic policies to realize a larger effect

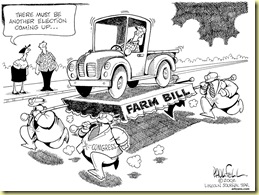

Then came the US view from Christine McDaniel, Deputy Assistant Secretary (Policy Coordination) in the Office of Economic Policy at the Department of Treasury, who argued that the US “cannot isolate our path to prosperity.” She argued that the Congress (particularly, the House Judiciary Committee) has been blocking a legislation on service liberalization abroad, especially from India (I think it is known as Mode 4 or 5, I am not sure though!). I was expecting to hear that the US would push forward for the success of the Doha Round sooner than later. However, she opined that we should expect some more years to make Doha Round a success (the Uruguay Round took 8 years of negotiation), and expected president of the WB, Robert Zoellick, to vigorously push forward this agenda as he did during the Uruguay Round. She made a honest remark by admitting that any passage of crucial multilateral bill depends on how well the US economy is doing. In other words, in today’s context- slump in the housing market, fears of recession, financial turmoil, sub-prime market crisis, high oil prices- the immediate success of the Doha Round is of just not possible. There also might be a high potential for investment protectionism (we’ve already seen in the case of Unocal). Also, she opined that given the way in which the global economy is locked in low tariffs, no future President would be able to turn that around unless there is a major economic shock!

Then came the US view from Christine McDaniel, Deputy Assistant Secretary (Policy Coordination) in the Office of Economic Policy at the Department of Treasury, who argued that the US “cannot isolate our path to prosperity.” She argued that the Congress (particularly, the House Judiciary Committee) has been blocking a legislation on service liberalization abroad, especially from India (I think it is known as Mode 4 or 5, I am not sure though!). I was expecting to hear that the US would push forward for the success of the Doha Round sooner than later. However, she opined that we should expect some more years to make Doha Round a success (the Uruguay Round took 8 years of negotiation), and expected president of the WB, Robert Zoellick, to vigorously push forward this agenda as he did during the Uruguay Round. She made a honest remark by admitting that any passage of crucial multilateral bill depends on how well the US economy is doing. In other words, in today’s context- slump in the housing market, fears of recession, financial turmoil, sub-prime market crisis, high oil prices- the immediate success of the Doha Round is of just not possible. There also might be a high potential for investment protectionism (we’ve already seen in the case of Unocal). Also, she opined that given the way in which the global economy is locked in low tariffs, no future President would be able to turn that around unless there is a major economic shock!

Then Will Martin presented the World Bank’s views on the Doha Round and argued that the success of this round would mean a lot to the developing countries. Gawain Kripke from Oxfam America presented civil society view and Steve Suppan from Institute for Agriculture and Trade Policy presented some thorny issues on biopiracy (he constantly referred to ‘blue box’, but I don’t know what this exactly is!).

Interesting stuff came from Devesh Roy from International Food Policy Research Institute (IFPRI). He made four points that were completely different from what others panelist were arguing about the developing countries.

Interesting stuff came from Devesh Roy from International Food Policy Research Institute (IFPRI). He made four points that were completely different from what others panelist were arguing about the developing countries.

-

Subsidies and agriculture market distortion is not exclusively a North phenomena. There is huge amount of distortion and subsidies in the developing world as well ($15 billion farm support recently in India is a form of subsidy).

-

There are limits to what agriculture can bring to poverty reduction and growth. China’s success is attributable to off-farm activities.

-

There is huge domestic market price distortion in the developing countries because of geographical/topological factors. The developing countries are not homogenous geographically, so the mountain region in Nepal has 18 times higher prices of food than in the plains. Similar is the case in India and Bangladesh. It has nothing to do with trade and the Doha Round would have little impact on these prices unless we complement agriculture reform with investment in infrastructure to reduce transport and transaction costs.

-

Unless we check the current state of high commodity prices, which has been skyrocketing by almost 200%, the Doha Round, even if it succeeds- would mean little because the developing countries like India has already banned rice exports, which will hurt poor neighbors like Nepal and Bangladesh.

Okay, this is getting longer than I thought. I would like to point out my earlier perspectives on the recent Indian farm bail outs. I think what the Indian government did was good (think historical injustice backed by feudal society and caste-based discrimination) and was needed because the market in that particular sector was in stalemate and poor farmers were in a ‘debt trap’. Obviously, the market created the trap (adverse selection and moral hazard) and it was unable to break it ; so, we need an exogenous force to break the trap for once and set appropriate conditions for the credit market to work for the poor farmers. Can't we view this debt write offs similar to the US stimulus package of about $150 billion? See here for extended discussion about the Indian debt write off in the farm sector.