Sanjay Reddy, in a new one pager from the IPC, argues that the new global poverty estimate ($1.25 a day) just digs dipper into the pitfalls of earlier estimate. He is unsatisfied with the methodology used in the survey. Here is a paper, written by the World Bank economists Ravallion and Chen, Reddy is referring to. Check this one as well (Dollar a day revisited). Here is more from Reddy.

...The new international poverty line is too low to cover the cost of purchasing basic necessities. One could not live in the US on $1.25 a day in 2005, nor therefore on an equivalent amount elsewhere. One’s daily income can be a great deal higher than $1.25 and still leave one unable to fulfill basic nutritional requirements. Since the international poverty line is defined in equivalent purchasing power units, this incoherence is not easy to overcome.

...The PPPs calculated for each country also inappropriately reflect irrelevant information about the pattern of consumption in third countries other than the country in which the price level is being assessed and the base country with which prices are compared (the US). This is because the worldwide pattern of consumption determines the weights placed on different commodities when assessing the price level in each country.

...The underlying source of the problems is the lack of a clear criterion for identifying the poor. We have no basis to conclude that the new set of PPPs generate poverty estimates which are closer to the “truth”.

...The relative extent of poverty in different countries and years, and the estimated trend, is dependent on the base year chosen for the exercise and there is no convincing basis to pick the estimates corresponding to one base year over those corresponding to another.

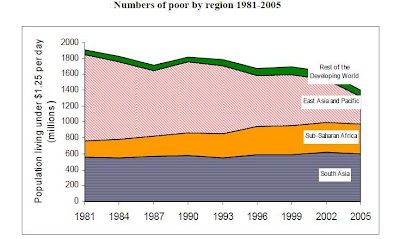

After the WB published new poverty estimate, which upped the number of people living below the global poverty line to 1.4 billion from around 800 million, the Asian Development Bank (ADB) also published its own estimate of poverty line for Asia. The ADB set Asian Poverty Line at $1.35 per day. Here is more about the new global poverty estimate from The Economist.