The following paragraphs are pertinent to the Nepalese context. All are related to a recent book titled "Reimagining India: Unlocking the Potential of Asia’s Next Superpower".

Sheridan Jobbins (Extracted from a review of the book):

Sheridan Jobbins (Extracted from a review of the book):

Fareed Zakari:

The complexity of India is picked up by Coca Cola’s Muhtar Kent, the son of a diplomat who spent his formative years in India. “If you come to India with some grand, predetermined strategy or master plan, prepare to be distracted, deterred, and even demoralized.” If that sounds daunting, he proceeds with optimism by detailing a plan for success: focus on training and talent recruitment, and source products from within India to deepen ties to the market. Among his stories is that of the 5by20 initiative, “which seeks to bring additional business training, finance opportunities, and mentoring to five million women entrepreneurs across our global value chain by 2020. Indian women make up a significant focus of this program.”

Anand Mahindra:

I remain optimistic. We are watching the birth of a new sense of nationhood in India, drawn from the aspiring middle classes in its cities and towns, who are linked together by commerce and technology. They have common aspirations and ambitions, a common Indian dream—rising standards of living, good government, and a celebration of India’s diversity. That might not be as romantic a basis for nationalism as in days of old, but it is a powerful and durable base for a modern country that seeks to make its mark on the world.

Yasheng Huang:

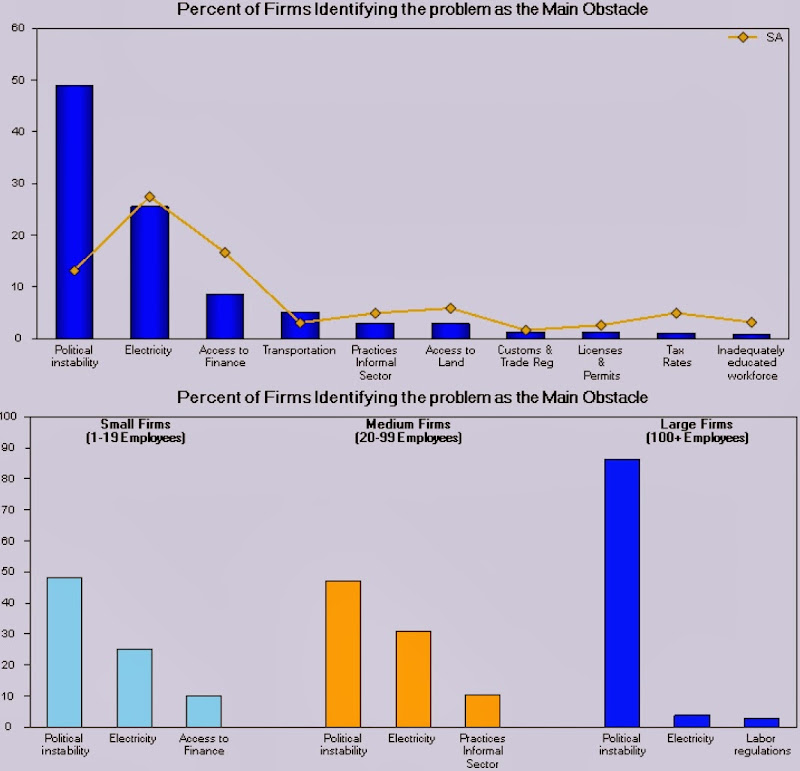

All Indian states will have to improve their infrastructure and climate for doing business if they want to contend for major projects. In this way, investment will drive innovation and changes to the system much more efficiently than any edict from Delhi could. Tata Motors’ decision to shift its Nano project from West Bengal to Gujarat illustrates the point.

You have to include the workers, the women, villagers, and the rural Indians into the growth machine. We’re talking about simple manufacturing. We’re talking about simple service-sector jobs that require basic reading, a little bit of math, functional capabilities. And labor regulations in India are killing those potentials. They don’t kill the IT, they don’t kill the high tech, but they do kill the blue-collar manufacturing jobs, which India needs the most.

The other area that would require more government intervention is in the social sector—health and education. If the government doesn’t provide health and education, nobody can come close to matching the government. And this is where you actually want more government intervention. You want more tax money to go in those sectors. And the Indian government is not able to collect enough taxes to spend on health and education; it is also constrained administratively and politically in terms of scaling up education.

If India doesn’t fix the problem of education—primary-education, first-tier education—they are going to undermine their success in the high-tech sector. The reason is very simple. The tertiary education requires a long pipeline of college-ready students. If you don’t fix your primary education, if you don’t fix your high school, primary school, you’re going to have a very narrow pipeline.