[This review was published in The Week (Republica), February 2, 2012]

An attempt to fill the void

Often students and researchers express frustration over the lack of books and journal publications about Nepali economy. It is even harder to get hold of a book that focuses exclusively on economic growth and private sector development in Nepal. Samriddhi, The Prosperity Foundation’s new book Economic Growth and the Private Sector of Nepal attempts to fill that void. Edited by Prateek Pradhan, the book has contributions from eleven authors who look into a range of issues – including economic reforms, stability, tourism, hydropower, state-owned enterprises, financial market, and trade – affecting Nepal’s economic growth and its private sector.

Prem Khanal delves into the resistance to economic reforms and its impact on democracy. He argues that the Panchayat regime plundered the state’s resources to influence the Referendum in 1980 and controlled licenses for production and imports, partially contributing to a balance of payments crisis and macroeconomic instability. This forced the country to knock on the doors of the IMF and the World Bank for loans to balance its budget sheets. No wonder, the Panchayat regime was unhappy with the implementation of Structural Adjustment Program in 1985, which forced austerity measures in a number of areas. The Nepali Congress government headed by the Prime Minister Girija Prasad Koirala enacted liberalization reforms after 1992 by introducing a range of policy reforms related to trade, labor, industry, investment, finance, and currency convertibility. Khanal provides a narrative of the evolution of this process and focuses on how resistance to reforms on three particular aspects –financial, labor, and public enterprises – attenuated faith in democracy.

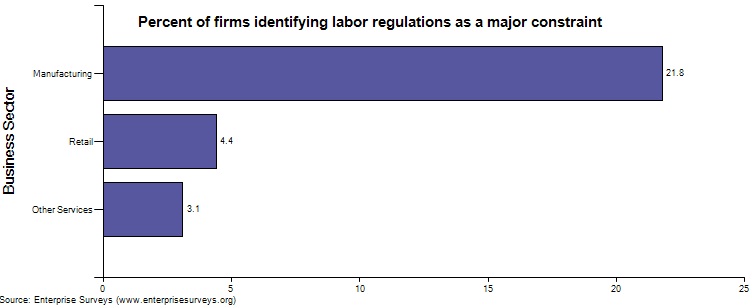

He argues that it was precisely because of resistance to financial sector reforms that the two largest state-backed banks—Nepal Bank Limited and Rastriya Banijya Bank—failed to recoup bad loans and reduce share of non-performing assets in their portfolio. The resistance came from “financially powerful and politically influential defaulters.” It was aided by the incapacity of the central bank to effectively supervise the building up of bad loans in these banks. As the discussion starts to get interesting and enriching, Khanal stops there, leaving readers to wonder about the nature of resistance to financial reforms and the power dynamics between defaulters and political leaders. On labor reforms, he explains the opposition to change the rigid provisions, such as permanent status and hire and fire rules, in the Labor Act and its impact on industrial production and productivity.

The resistance to such reforms is continuing to this day, something apparent from the fact that the amended Labor Act of 1992 is still not enacted by the Parliament. Meantime, we are seeing the decline of industrial strength and demise of many sectors, chief among them the garment and textiles sector. Similarly, the resistance to restructure and reform financially insolvent and inefficient public enterprises has cost taxpayers billions of Rupees for decades now. Khanal tries to score the point that resistance to reforms has impeded economic growth and prosperity, diminished productive capacity, and fueled public discontent. It would have been even more revealing if Khanal had delved into the dynamics of the power play between interest groups and the political system, and its impact on Nepal’s private sector development. Nevertheless, his chapter is one of the few comprehensive contributions in the book.

Dr. Dandapani Paudel attempts to chart out a new approach to fiscal and monetary policy in general and articulate a new approach to the IMF’s and World Bank’s macro management strategies in particular. He argues that had it not been for remittances, the macroeconomic stability would have been horribly derailed by unsustainably high trade deficit. On top of currency stability, interest rate, fiscal deficit and debt, he outlines a set of additional indicators (inflation, real GDP growth, broad money supply, and trade deficit) to gauge macroeconomic stability. However, these are not new indicators and are in fact a part of the indicators to assess stability. As importantly, he also omits balance of payments (BoP) surplus as an important indicator of stability. It was precisely because of BoP deficit that Nepal took loans from multilateral donors to finance restructuring of the economy in 1985. While discussing the flaws of monetary and fiscal policies, Paudel falls short of linking them to economic growth and elaborate how deterioration of macroeconomic indicators affected private sector development over the years.

Meanwhile, Dr. Durga P. Paudyal reflects on development agendas for New Nepal and its relation to stability, prosperity and equality. He argues that there is no point bashing political leaders who seem to be more responsive to donors than to their own citizens when the entire system is flawed. While outlining how donors are corrupting political leaders and influencing them to be towed along with the donors’ development agendas, Paudyal accentuates the need to have a greater debate on forward-looking development policies. Unfortunately, he fails to provide the baseline arguments for a serious discussion on these issues. Equally importantly, he also falls short of explaining how these will affect stability, prosperity and private sector.

Dipendra Purush Dhakal focuses on tourism policies to spur economic growth. While outlining the evolution of policy initiatives for tourism development, starting with the Tourism Master Plan of 1952 and ending with the Tourism Vision 2020, he argues that the private sector has played a decisive role in this sector by constantly introducing a slew of innovative tourism packages. Dhakal maintains that success of tourism sector should not be measured by the number of tourist arrival, but by tourism receipts, average days of stay, and quality of services. Even though Dhakal emphasizes the role of private sector in tourism development, he overlooks the process of how that happened and in what way the government facilitated or hindered their participation. Gyanendra Lal Pradhan writes about growth through private sector-led hydropower development, which has so far been limited to 174MW. The country needs at least 2,500MW of electricity by 2015 to end load-shedding, and there is no alternative to this source of power supply, given the increasing demand for energy. Pradhan argues that lack of affordable credit, favorable purchasing agreements, and insecurity has been the biggest constraints to private sector-led hydropower development.

Rameshore Prasad Khanal writes about the sorry state of state-owned enterprises (SOEs) due to poor liability management. His contribution is more like a primer on liability management. Not all SOEs, whose contribution is around 11% of the GDP, suffer from the same problems, and liability management is an issue in only some of them. Note that out of the 36 public enterprises, 16 earned profits in 2009/10. A focused discussion on specific liability management issues of key SOEs and the hurdles in correcting them would have been more interesting to readers. The evolving operational domain of private sector and SOEs is also little explored.

Siddhant Raj Pandey writes about the role of financial market openness in capital inflows. He argues that even though the gradual opening up of the financial sector to international players has enhanced value and standard of domestic financial industry, without total capital account convertibility, however, the prospect for huge capital inflows is low. Pandey’s brief contribution lacks the depth needed to understand why capital inflows would remain subdued without total capital account convertibility and whether this is the main indicator looked at by foreign investors to decide on investing in Nepal. Many countries have not fully liberalized capital account, for fear of exchange rate volatility and sudden negative shocks on economy, but still have managed to entice huge sums of foreign investment.

Dr. Jagadish C. Pokharel discusses the benefits of connecting the country with the two bordering economic giants. Pokharel argues that Lumbini, Pokhara, Nijgad, and Kathmandu will be the economic centers in the future if appropriate infrastructure linking the economy with India and China are constructed. The export of herbal products to China and energy to India and tourism to both countries will generate tremendous benefits to the country, he asserts. Pokharel emphasizes the role of infrastructure, the most binding constraint to growth, in spurring growth but does not look at the role of private sector in this endeavor.

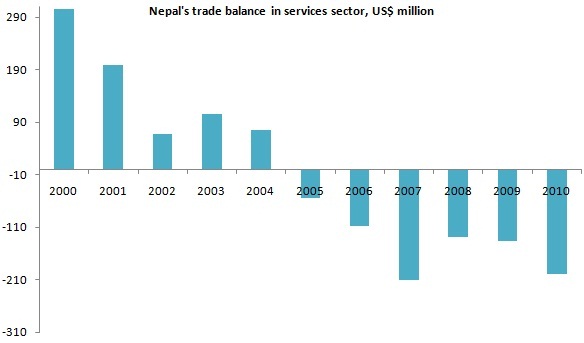

Ratish Basnyat has one of the most consistent and comprehensive contributions on international market access for Nepali exports. He outlines a range of supply-side constraints that are hampering exports growth, both in regional as well as international markets, despite being a member of free trade blocs like WTO, SAFTA, and BIMSTEC. He also argues that Nepal’s exports to India failed to pick up steam because our exporters relied more on tariff preference to India rather than increasing competitiveness of products. As the preferences are declining along with the liberalization of Indian economy, Nepali exporters are finding hard to compete there was well. The failure of private sector to read preference erosion correctly and do the needful on their part to sustain exports growth is to blame for the dismal performance. He argues for the creation of Infrastructure Development Fund, skill development, and area-specific product development for industrial and exports promotion.

On the same issue, Tarka Raj Bhatta writes about what needs to be done to boost export diversification and competitiveness. Despite being a very important and profound issue, Bhatta offers general arguments without substantive discussion on the role of private sector and the impact of low export diversification on growth. Finally, Shiv Raj Bhatt tries to explain how the Nepal-USA Trade and Investment Framework Agreement (TIFA) can help revive Nepal’s trade with the US. As with the preceding contribution, Bhatt offers general points without meaty discussion on how exactly Nepal can exploit the provisions in TIFA to boost exports to the US in the face of the slump in exports of garments, our main product of interest in the US market.

In general, the major strength of the book is that now we have a publication about growth and private sector. Apart from the few comprehensive contributions, the book is a disappointment to serious readers who are in hunt for substantive and measured arguments on growth and private sector development. Readers will wonder why the editor did not even have a foreword or an introduction or a chapter contribution. Furthermore, there is serious editing slackness with regard to clarity and consistency of arguments in some chapters (sometimes even in the same paragraphs), lack of complete reference, and up-to-date data. Contributors such as Khanal, Pradhan and Basynat have tried to focus on the core theme, but others have digressed from it, giving readers a sense of a lack of unifying theme or message that relates to the title of the book.

[Published in The Week, Republica, February 3, 2012, p.11]

The information is derived from from a recent

The information is derived from from a recent