Here is the executive summary and FY2017 growth and inflation outlook adapted from ADB Nepal's Macroeconomic Update, Vol.5, No.1.

Macroeconomic Update

1. Despite suppressed services output because of the deceleration of remittance inflows, a bumper agricultural output, prospects of a pick-up in post-earthquake reconstruction in the last two quarters of FY2017 and an improving investment climate warrant an optimistic growth outlook than the previous update. The above average monsoon rains and the smooth availability of agricultural inputs, particularly chemical fertilizers, is likely to significantly boost agricultural output. Similarly, the notable improvement in power supply, the resumption of manufacturing activities following the lull after the earthquakes in 2015 and supplies disruption in 2016, and pick up in post-earthquake reconstruction works are expected to boost industrial output. The deceleration of remittance inflows and a marginal effect of the demonetization of higher denomination currency notes in India will likely suppress services activities from its potential level. However, services output is expected to be higher than in the last two years. Overall, tailwinds from the expected acceleration in post-earthquake reconstruction, a slight uptick in demand following the disbursement of housing grants and the election related expenditures may negate the headwinds from the demand dampening effect originating from deceleration of remittance inflows, demonetization shock in India and some degree of political instability in the Terai region. However, there still remains uncertainty over the intensity of these opposing forces. Hence, gross domestic product (GDP) growth (at basic prices) is forecast to grow between 5.2% and 6.2% in FY2017.

2. Although FY2017 budget was announced one-and-a-half month before the start of the fiscal year on the expectation it will provide enough time to plan for procurement and approvals, the expenditure performance till the first half of the fiscal year is not encouraging. The monthly expenditure pattern is similar to the ones seen in the previous years. Actual spending was just 26.2% of the planned spending by the first half of FY2017, the same as in the first half of FY2015 but lower than 30.2% in the same period in FY2014. Actual recurrent spending was 35.4% of planned recurrent budget, higher than 30.9% in the first half of FY2015. However, capital spending was just 11.3% of the planned capital budget, lower than 12.6% and 13.5% in FY2015 and FY2014, respectively. It is very likely that actual capital spending will heavily bunch in the last quarter of FY2017, indicating a persistently weak budget execution capacity of the government. The Ministry of Finance has outlined a series of measures to expedite capital spending.

3. The mid-year revenue mobilization stood at NRs277.6 billion, which is 49% of the total revenue (tax and non-tax) target for FY2017. It is about 69% higher than the revenue mobilized in the first half of FY2016. As a share of total targets, customs, value added tax (VAT), excise and income tax mobilization up to mid-year stood at 60.4%, 45.4%, 54.2% and 50.1%, respectively. Import-based revenues accounted for about 62% of total revenue in the review period. Overall, tax and non-tax revenue target for FY2017 looks achievable primarily because of the surge in imports following the supplies disruption last year. However, a downside risk to achieving the target is the slowdown in import of vehicles because of liquidity crunch in the last few months.

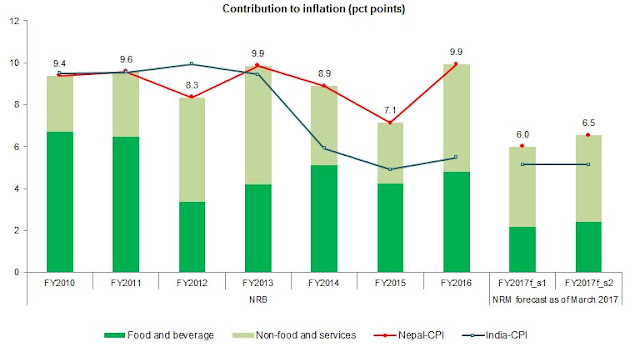

4. Inflation averaged 5.8% in the first half of FY2017, sharply down from 9.4% in the corresponding period in FY2016 and 9.9% in FY2016. The downward correction of prices following the highs during and after the crippling supplies disruption was expected as supplies gradually normalized (narrowing down the gap between demand for and supply of goods and services) along with the favorable monsoon (which boosted agricultural output), improved power supply (which is exerting downward pressure on cost of production) and substantial cooling off of prices in India. Food and non-food inflation averaged 4.2% and 7.1% in the first half of FY2017. Considering the normalization of supplies, rosier prospect for agricultural output, continued low fuel and commodity prices, subdued inflation in India, and lower than expected pace of post-earthquake reconstruction efforts so far, inflation in FY2017 is expected to undershoot the government’s target and hover between 6.0% and 6.5%. A deterioration of political situation is a major downside risk to the forecast.

5. Despite a significant increase in net domestic assets, a slowdown in net foreign assets of the banking sector led to a marginally lower growth of money supply (M2). M2 increased by NRs180.9 billion by mid-January 2017 (against the level in mid-July 2016), up from NRs169.8 billion compared to the corresponding period in FY2016. Net foreign assets grew by 4.7% (NRs45 billion), down sharply from a 18.7% growth rate (NRs139.7 billion) in mid-January 2016. The deceleration of remittance inflows contributed to the slowdown in building up of net foreign assets. The increase in M2 was reflected in the 5.1% growth of narrow money (M1) and 15.9% growth of time deposits.

6. The banks and financial institutions (BFIs) mobilized NRs144.4 billion (reaching a total of NRs2,161.2 billion) in deposits in the first six months of FY2017, higher than NRs100.9 billion mobilized in the corresponding period in FY2016. This translates into a growth of 7.2%, up from 6.0% in the first half of FY2016. Meanwhile, total credit (loans and advances) of BFIs increased by 11.0% (NRs208.5 billion) in the first half of FY2017, up from 4.3% growth in the corresponding period in FY2016 (NRs65.9 billion). The short-term interest rates remained higher than in the corresponding periods in FY2016, reflecting the liquidity crunch in the financial sector. The weighted average deposit rate of commercial banks was as low as 3.29% in mid-August 2016 and rose to 3.98% by mid-January 2017. Meanwhile, the weighted average lending rate was 8.88% in mid-August 2016 and rose to 9.31% by mid-January 2017.

7. The country’s external situation weakened as import growth outstripped export growth and remittance inflows decelerated. In the first half of FY2017, balance of payments surplus drastically decreased and current account balance was negative. The balance of payments surplus decreased to $419.6 million from $1.3 billion in the corresponding period in FY2016. The merchandise trade deficit widened to $3.9 billion, much larger than in the previous corresponding periods. This and deceleration of remittance inflows contributed to the current account deficit of $10.1 million, down from a surplus of $1.5 billion in the corresponding period in FY2016. The capital and financial accounts saw increases in net surpluses. Gross foreign exchange reserves increased from $9.7 billion in mid-July 2016 to $10.0 billion by mid-January 2017, sufficient to cover about 12.4 months of import of goods and non-factor services.

FY2017 growth outlook

8. Despite suppressed services output because of the deceleration of remittance inflows, a bumper agricultural output, possibility of a pick-up in post-earthquake reconstruction in the last two quarters of FY2017 and an improving investment climate warrant an optimistic growth outlook than in the previous update. The above average monsoon rains and the smooth availability of agricultural inputs, particularly chemical fertilizers, is likely to significantly boost agricultural output.

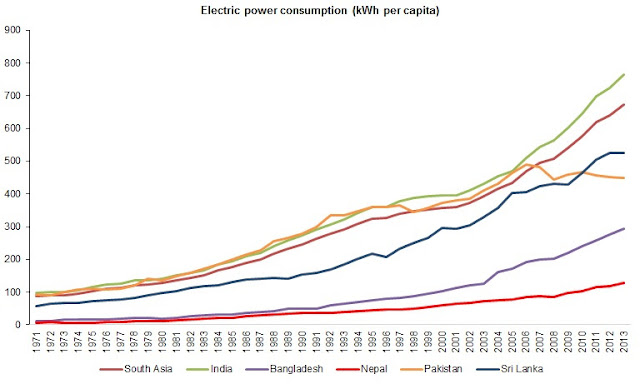

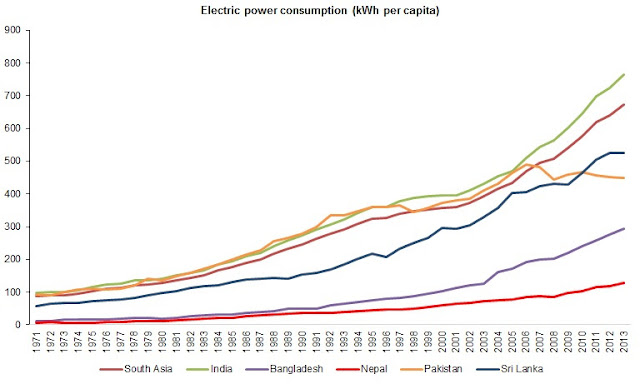

9. Similarly, industrial output will be robust following a negative growth last year due to the four-and-a-half month long crippling supplies disruption. Specifically, the notable improvement in power supply and the resumption of manufacturing activities following a lull after the earthquakes in 2015 and the supplies disruption in 2016 will underpin a robust manufacturing sector growth. Meanwhile, the expected pick up in reconstruction of houses and settlements (in line with the latest acceleration in grant disbursement by National Reconstruction Authority [NRA]) will support growth in construction and mining and quarrying activities. Furthermore, addition of electricity from small hydropower projects this year will support growth of electricity, gas and water subsector. Increase in capital spending in the last quarter is also expected to boost construction, manufacturing and mining activities.

10. The deceleration of remittance inflows and a marginal effect of the demonetization of higher denomination currency notes in India will likely suppress services activities from its potential level. The growth of migrant workers is expected to fall in FY2017 as well because of the slowdown in investment in the major overseas employment destinations (following the impact of low oil prices in the last several years), resulting in deceleration of remittance income. Consequently, wholesale and retail trade activities, the largest contributor to GDP growth after agriculture, are not going to be as robust as in FY2014 although the expected growth in FY2017 will be higher than in the last two years. The demonetization shock, which has already affected economic growth and inflation in India, has marginally affected remittance inflows from India, trading activities and investment in micro and small enterprises along the border areas. The marginal effects may linger until the normalization of the currency demand and supply in India. On the other hand, a surge in visitor arrivals, which had remained subdued in the last two years, will boost tourism activities. Additionally, the local elections, which are scheduled for 14 May 2017 related spending7 will boost consumption demand and will likely compensate for the dampening effect of deceleration of remittance and marginal effect of demonetization in India.

11. Overall, tailwinds from the expected acceleration in post-earthquake reconstruction, a slight uptick in demand following the disbursement of housing grants and the election related expenditures may negate the headwinds from the demand dampening effect originating from deceleration of remittance inflows, demonetization shock in India and some degree of political instability in the Terai region. However, there still remains uncertainty over the intensity of these opposing forces. Hence, GDP growth (at basic prices) is forecast to grow between 5.2% and 6.2% in FY2017. Specifically, the lower forecast is based on the assumption of a dented services sector growth and an agricultural output growth normally registered during times of favorable monsoon rain. The higher forecast is based on the assumptions of a stronger-than-expected agricultural output growth and less-than-expected deterioration of political situation as the local elections day approaches. A more definite forecast (i.e., a point estimate) will be available in Asian Development Outlook 2017, which takes into account the latest data and information available. Compared to the estimate in August 2016, the latest forecast revises upward the outlook for agricultural and industrial sectors.

FY2017 inflation outlook

12. In addition to the normalization of supplies, a rosier prospect for agricultural output, continued low fuel and commodity prices, subdued inflation in India, and lower than expected pace of post-earthquake reconstruction efforts in the first half of FY2017, inflation is revised downward from the forecast in our previous update. A faster decline in prices of perishable and daily consumable goods as well as consumer durables largely accounted for the downward revision of inflation forecast for FY2017. Specifically, more than anticipated bumper agriculture harvest— thanks to the above average monsoon rains and the smooth availability of agricultural inputs, particularly chemical fertilizers— and faster than expected deceleration of consumer prices in India (partially contributed by the demand shortfall arising from demonetization shock in November 2016) played a critical role in such a forecast revision. Furthermore, the notable improvement in electricity supply this year has also decreased cost of production for business and household enterprises. That said, rise in international fuel prices and political disturbances—especially in the Terai region, as local elections, which are scheduled for May 14, approaches— may exert upward pressures on general prices of goods and services. The other likely sources of upward price pressures are direct and indirect election related expenses as political campaign intensifies and a demand boost arising from the expected acceleration in post-earthquake reconstruction works in the remaining period of this fiscal year.

13. Considering these factors, headline inflation in FY2017 is expected to undershoot the government’s target and hover between 6.0% and 6.5% (Figure 15). A substantial moderation of prices of cereal grains, pulses and legumes, ghee and oil, spices and vegetables will exert downward pressures on overall food prices and contribute between 2.2 and 2.4 percentage points to the forecasted overall inflation. Similarly, non-food and services prices, which account for 56.1% weight in the CPI basket, are also expected to cool off on account of either stabilization or moderation of prices of consumer durables and utilities. It is expected to contribute between 3.8 and 4.1 percentage points to the overall estimated inflation. A deterioration of political situation is a major downside risk to the forecast. A more definite forecasted point estimate is available in Asian Development Outlook 2017, which takes into account the latest data and information available.