The economic impact of COVID-19 is still an evolving topic. One thing for sure is that it will be a combination of supply and demand shocks and followed by a financial shock. A complex vortex of these three shocks will complicate policy response. Unconventional monetary as well as fiscal policies are required for quite some time. The most effective fiscal response for the immediate-term are those geared to boost consumer demand such as direct cash transfers to those losing jobs or facing reduced working hours. Similarly, any facility to improve cash flow or to cushion against rising debt of MSMEs is going to be a huge relief to businesses. This could be done through interest and principal moratorium, cheaper and easier line of credit, rapid on-lending facilities, government buy back of production for the interim period, tax incentives, etc. It will essentially be a combination of fiscal and monetary policies.

Here some articles related to the underlying emerging economic dynamics and how to resolve it.

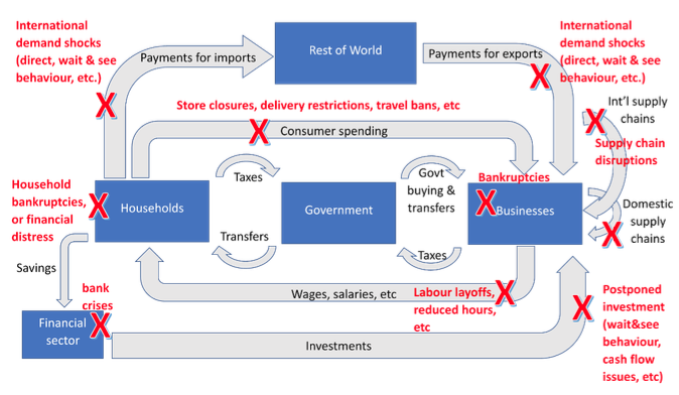

1. Baldwin presents widespread disruption depicted through a circular flow of income diagram.

2. Fornaro and Wolf present a simple framework that shows how a demand-driven slump gives rise to a supply-demand doom loop, opening doors to stagnation traps induced by pessimistic animal spirits. The COVID-19 pandemic induces expectation-driven stagnation traps.

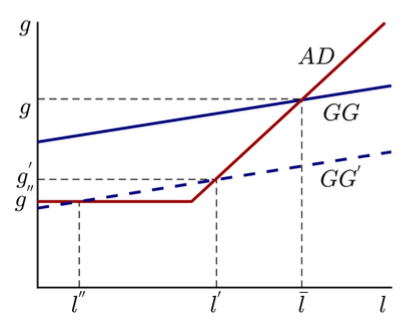

It follows a standard New Keynesian model where aggregate demand determines output and employment. So, aggregate demand depends positively on productivity growth as faster productivity growth boosts agent's expectation of future growth and induce them to spend more now. If the COVID-19 pandemic reduces productivity growth, then aggregate demand falls, resulting in involuntary unemployment and a demand-driven recession. However, since investment depends on aggregate demand (which remains suppressed in the face of slower productivity growth), firms will have less incentives to invest. This creates demand supply doom loop. Furthermore, if there is zero lower bound constraint on monetary policy, then an economy faces a kinked aggregate demand curve. A reduction in productivity growth (GG curve shifts downward) means lower productivity growth (g) and employment (l). Eventually, pessimistic animal spirits push the economy into a stagnation trap (lower equilibrium). Against this backdrop, conventional monetary policy is ineffective. Fiscal policy that is geared to boost aggregate demand (which incentives investment and leads to higher productivity) is helpful.

Jordi Gali argues that the time has come for helicopter money- direct, unrepayable funding by the central bank of additional fiscal transfers deemed necessary. It puts less burden on fiscal policy (if taxes are raised or government debt is increased).

The pandemic is reducing consumption of goods and services, which will hit GDP growth. It is also leading to a significant reduction in employment (which then lowers income and consumption). Firms may try to keep payroll unchanged but keep meeting other fixed costs (rent, interest, etc) by taking loans. But, banks may not lend more due to the probability of default and deterioration of balance sheets. This requires a swift and well targeted policy response.

Government could cover payroll and other unavoidable expenses of affected firms. Ideally, this must be non-repayable transfer. But, this means government will have to raise taxes or to borrow from capital markets and increase debt burden. Gali argues that quantitative easing, a massive purchase of newly issued debt by central bank, could be helpful but this increases government debt too, putting public finances in unsustainable path. He proposes ‘helicopter money'- unrepayable funding by the central bank of the additional fiscal transfers deemed necessary. The central bank simply credits the government's account and it adjusts accounts by showing a reduction in its capital or insert a permanent annotation on the asset side of the balance sheet. This should be used only during emergencies.

It follows a standard New Keynesian model where aggregate demand determines output and employment. So, aggregate demand depends positively on productivity growth as faster productivity growth boosts agent's expectation of future growth and induce them to spend more now. If the COVID-19 pandemic reduces productivity growth, then aggregate demand falls, resulting in involuntary unemployment and a demand-driven recession. However, since investment depends on aggregate demand (which remains suppressed in the face of slower productivity growth), firms will have less incentives to invest. This creates demand supply doom loop. Furthermore, if there is zero lower bound constraint on monetary policy, then an economy faces a kinked aggregate demand curve. A reduction in productivity growth (GG curve shifts downward) means lower productivity growth (g) and employment (l). Eventually, pessimistic animal spirits push the economy into a stagnation trap (lower equilibrium). Against this backdrop, conventional monetary policy is ineffective. Fiscal policy that is geared to boost aggregate demand (which incentives investment and leads to higher productivity) is helpful.

Jordi Gali argues that the time has come for helicopter money- direct, unrepayable funding by the central bank of additional fiscal transfers deemed necessary. It puts less burden on fiscal policy (if taxes are raised or government debt is increased).

The pandemic is reducing consumption of goods and services, which will hit GDP growth. It is also leading to a significant reduction in employment (which then lowers income and consumption). Firms may try to keep payroll unchanged but keep meeting other fixed costs (rent, interest, etc) by taking loans. But, banks may not lend more due to the probability of default and deterioration of balance sheets. This requires a swift and well targeted policy response.

Government could cover payroll and other unavoidable expenses of affected firms. Ideally, this must be non-repayable transfer. But, this means government will have to raise taxes or to borrow from capital markets and increase debt burden. Gali argues that quantitative easing, a massive purchase of newly issued debt by central bank, could be helpful but this increases government debt too, putting public finances in unsustainable path. He proposes ‘helicopter money'- unrepayable funding by the central bank of the additional fiscal transfers deemed necessary. The central bank simply credits the government's account and it adjusts accounts by showing a reduction in its capital or insert a permanent annotation on the asset side of the balance sheet. This should be used only during emergencies.