This blog post is adapted from an interview published in Deutsche Welle (DW) on 26 May 2015. An earlier updated economic outlook following Nepal’s earthquake is here.

More than 8,600 people died in two major quakes that hit Nepal on April 25 and May 12, destroying nearly half a million houses and leaving thousands desperate for food, shelter and water. Thousands more have been left homeless and are camping out in the open, with just weeks to go until the monsoon rains. The UN estimates eight million people - nearly a third of Nepal's population - may have been affected by the earthquake, with at least two million people needing tents, water, food and medicines over the next months.

In a DW interview, Chandan Sapkota, economics officer at the Nepal office of the Asian Development Bank (ADB), talks about the extent of the economic damage caused by the disaster, what it will take to rebuild the Himalayan nation's shattered economy and where the money for reconstruction is likely to come from.

DW: In monetary terms, how would you assess the scale of the damage caused by the quakes?

Chandan Sapkota: The 7.8 magnitude earthquake on April 25 and the subsequent aftershocks - including a 6.7 magnitude tremor on April 26 and a 7.3 magnitude quake on May 12 - have caused widespread damage to lives, property and livelihoods. Over 8,600 people are dead, and the number of injured is nearing 22,000.

Furthermore, over half a million houses have been destroyed. Many businesses are fully or partially closed and tourists are staying away. A clearer picture on the full cost of the earthquake will emerge following the post disaster needs assessment, which is scheduled to be completed by mid-June, but the government has suggested it could be $5-$10 billion. Certainly, monetary and other costs to Nepal are huge.

Which parts of the country are most affected?

Almost half of the 75 districts in Nepal have been affected one way or another. However, the damage is most pronounced in the upper belt of central and western administrative regions - Kathmandu valley falls within the central region. The government has identified 14 districts as severely earthquake-hit areas for rescue and relief operations. These districts account for 15.5 percent of the total land area of Nepal.

Rural roads, schools, community centers, health posts, bridges, homes, farmland, livestock, food stock and heritage sites have been particularly badly damaged. Some key utilities like power distribution systems, water supply and sanitation facilities have also been affected.

How has this disaster impacted the country's economy?

The disaster has severely disrupted all economic activities - agricultural, industrial and services - in the earthquake-hit areas in varying degrees. Farmland, livestock and food stocks have suffered from landslides which is problematic so close to the planting season.

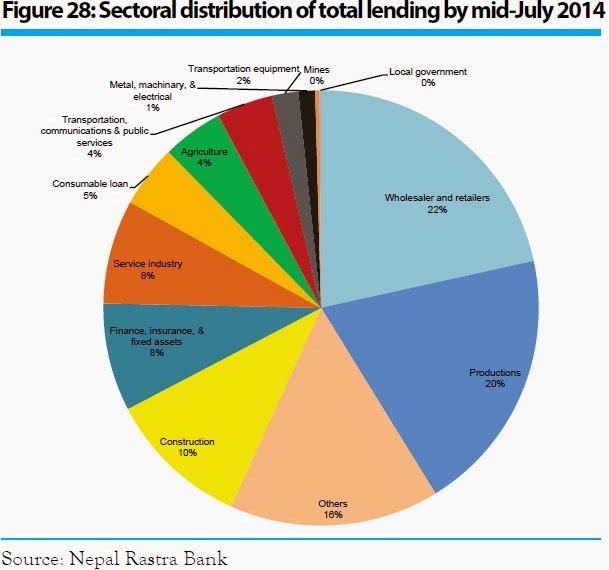

Power and water distribution, manufacturing and construction activities have also been disrupted. Meanwhile, retail and wholesale activities, the largest sub-sector save agriculture, and tourism have been hit hard. Schools, universities and financial services are only partially operational. Confidence in the real estate and housing markets has plummeted.

Supply disruptions have exerted upward pressure on food and non-food inflation. Exports have declined and imports have increased, widening the trade deficit and reducing the current account surplus. Slower economic activities means the government is pulling in less tax revenue than it anticipated, which will undermine its budget spending.

The earthquake has hit the poorest and marginalized populations in the remote areas most severely. There is a risk that the loss of livelihoods, coupled with higher food prices, will push a sizable number of people back below the poverty line, calling for urgent attention of providing livelihood restoration support in a timely manner.

With a well-designed recovery and reconstruction plan together with efficient relief operations, it is likely that the economy will rebound, including tourism activities, soon. Basic services are being gradually restored.

According to your estimate, how much money is needed to reconstruct the country, and what could be achieved with that amount?

It would be hard to put a number on reconstruction costs right now as a detailed assessment only started earlier in the middle of last week. At the least, it will be over $2 billion for rehabilitation and reconstruction of physical infrastructure and heritage sites. If we include the cost of retrofitting the buildings and facilities that survived the earthquakes, the total cost could be substantially more. The government has set up a $2 billion National Reconstruction Fund, to which it has contributed $200 million and is aiming to raise the remaining from donors.

What facilities need to be reconstructed first, and does the country have the necessary means to do this at the moment?

Full rehabilitation and reconstruction will be a mammoth task for the country. A massive and speedy effort is crucial before the onset of the monsoon expected around second week of June. This means temporary shelters, cash transfers, food supplies, sanitation and the resumption of basic public services, among others. Then, the difficult task of rehabilitation and reconstruction of roads, bridges, schools, health posts, water supplies, power distribution systems and world famous heritage sites should get going.

To do all this, the country will require a clear institutional set-up, legal mandate, and clear implementation arrangements. A separate lean, efficient apolitical body with a fixed operational lifetime may be helpful to expedite decision-making, procurement, and approvals although reconstruction projects be implemented through the line ministries that are best informed about their areas. This should be complemented by robust monitoring and evaluation mechanisms. In short, overall project implementation capacity needs to be drastically enhanced.

Where is Nepal expected to get the necessary funds from for reconstructing the country?

The country will need large amounts of funds for reconstruction. There are several avenues to bridge the gap. First, rationalization of ballooning recurrent expenditure could open up some space to increase capital spending, which stands at a mere 3.3 percent of GDP.

Second, a part of the fund could be raised domestically by selling bills and bonds. Bond sales could be larger than the government has typically done but the yield has to be attractive enough for the public, financial institutions and pension funds to buy. Likewise, the government may also consider raising revenue by a special time-bound tax targeted for reconstruction.

Third, external grants and loans - mostly on concessional terms from multilaterals institutions such as the Asian Development Bank and from bilateral donors - could cover the remaining funding need. Overall, we are hopeful about the country's fiscal resilience and discipline to be able to handle the reconstruction needs. Mobilizing funds is vital but the government needs to match this with a viable reconstruction plan and a clear strategy for implementation.

How is this likely to affect the country's economic outlook in the near and mid-term?

The earthquake and subsequent aftershocks will certainly impact economic growth, inflation, the external trade balance and the country's fiscal position. It will likely drag GDP growth down to 3.8 percent in the fiscal year (FY) 2015 ending July 15, 2015 - 0.8 percentage points lower than the 4.6 percent rate forecast in ADB's Asian Development Outlook 2015 (ADO 2015) published in March. Growth could be even lower - between three percent and 3.5 percent - if supply disruptions become more intense than we currently expect. GDP grew by 5.2 percent (at basic prices) in FY2014.

In FY2016, growth could rebound to 4.5 percent or higher contingent upon the scale and pace of rehabilitation and reconstruction efforts concerning physical infrastructure. The medium-term growth outlook depends on monsoon rains, a resurgence of investor confidence, and reconstruction efforts.

Lower agricultural output and supply disruptions will exert upward pressures on food and non-food prices, resulting in inflation to edge up to 8.2 percent in FY2015 and 8.5 percent in FY2016 In the medium term, the boost in aggregate demand as a result of higher reconstruction spending will likely keep inflation at elevated levels.

The fiscal deficit and current account balance will likely worsen in the medium-term. The country's ability to cope with possible shortages of construction materials and labor for reconstruction will also impact the outlook for growth, inflation and the external balance.

How is this likely to impact migration?

There could well be a net increase in outmigration, particularly if reconstruction is slow, which could create a shortage of labor, a further slowdown in reconstruction, and push up wages. Continuing the reforms to increase private sector investment, including through public private partnerships, in construction and labor-intensive manufacturing will be critical to create adequate jobs and restrain the outflow of workers in the short to medium term.

vember 2013 before declining to NRs40 billion towards the end of FY2014[4], throughout the year pushed short-term interest rates below 1% (Figure 31). The 91-day treasury bills weighted average rate was 0.25% in mid-August 2013, which declined to 0.02% in mid-July 2014 and averaged 0.13% in FY2014, much lower than 1.77% in FY2013. Similarly, inter-bank rate dropped from 0.3% in mid-August 2013 to 0.16% in mid-July 2014, and averaged 0.22% in FY2014, much lower than 1.77% in FY2013.

vember 2013 before declining to NRs40 billion towards the end of FY2014[4], throughout the year pushed short-term interest rates below 1% (Figure 31). The 91-day treasury bills weighted average rate was 0.25% in mid-August 2013, which declined to 0.02% in mid-July 2014 and averaged 0.13% in FY2014, much lower than 1.77% in FY2013. Similarly, inter-bank rate dropped from 0.3% in mid-August 2013 to 0.16% in mid-July 2014, and averaged 0.22% in FY2014, much lower than 1.77% in FY2013.