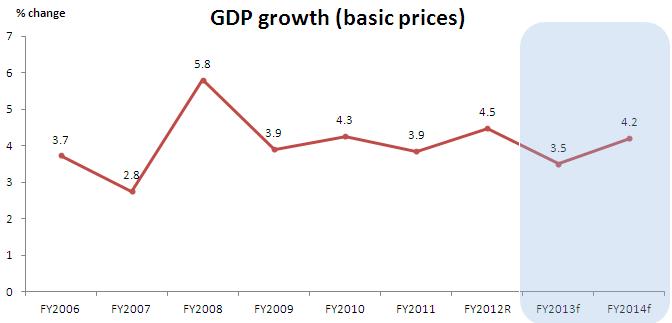

The Central Bureau of Statistics (CBS) released its annual national account estimate on 5 April 2013, projecting GDP at basic prices to grow at 3.56%, down from 4.48% revised estimate for FY2012 (fiscal year ends on 15 July). In FY2012, agriculture growth of around 5% and services growth of 4.5% propelled overall GDP growth (revised estimate) to 4.5%, up from 3.9% in FY2011. Industry sector growth dropped to 2.96% in FY2012 from 4.4% in FY2011. In 2012, the CBS’s GDP growth projection for FY2012 was 4.6%.

| GDP_NEPAL | FY2011 | FY2012R | FY2013P |

| GDP growth rate (basic prices) | 3.85 | 4.48 | 3.56 |

| Primary Sector | 4.48 | 4.98 | 1.31 |

| Secondary Sector | 4.4 | 2.96 | 1.49 |

| Tertiary Sector | 3.42 | 4.51 | 6.03 |

| Composition of GDP (%) | |

| Primary Sector | 37.37 | 36.31 | 35.32 |

| Secondary Sector | 14.94 | 14.30 | 14.35 |

| Tertiary Sector | 47.69 | 49.39 | 50.33 |

In FY2013, the CBS projects services sector to grow by 6.03%, industry sector growth to further drop to 1.49%, and agriculture sector to grow by a mere 1.31%. The sharp drop in agriculture growth is attributed to the unfavorable monsoon and shortage of chemical fertilizers during peak paddy planting season. The industry sector continues to be beset by persistent supply-side as well as structural constraints, including power outages, labor disputes, low productivity, high cost of raw materials and production, inadequate investment climate reforms, lack of innovation and research and development, corruption, and political instability. Given the slowdown in growth of remittances, it appears services sector might grow lower than what CBS’s is projecting. Hence, 3.56% GDP growth projection is very optimistic. Taking into account the latest developments and updates, GDP will likely grow between 3.2% (the IMF says it might be even below 3%) and 3.5%. Anyway, as in previous years, services sector will contribute the largest push to GDP growth rate in FY2013.

At the sub-sectoral level (GDP consists of 15 sub-sectors broadly categorized under three sectors, namely agriculture, industry and services), the highest growing (revised estimate) sub-sectors in FY2012 were health and social work (9.95%); electricity, gas and water (8.41%); fishing (7.55%); community and social activities (6.65%); hotels and restaurants (5.96%); mining and quarrying (5.03%) and education (5.02%). Construction registered the least growth(0.22%).

In terms of contribution to GDP growth rate (sub-sectoral growth rate times its share of GDP at factor cost), agriculture and forestry had the major role, followed by transport, storage and communication; wholesale and retail trade; education; community and social activities; and real estate, renting and business activities.

In FY2013, the CBS projects wholesale and retail trade to register highest growth (9.54%), followed by health and social work (6.95%); hotels and restaurants (6.84%); transport, storage and communication (6.73%); and mining and quarrying (5.45%). The three lowest growing sub-sectors are construction (1.57%); agriculture and forestry (1.21%); and electricity, gas and water (0.2%).

In terms of contribution to GDP growth in FY2013, the largest contributor is projected to be wholesale and retail trade, followed by transport, storage and communication; agriculture and forestry; financial intermediation; and education. The least contribution would come from mining and quarrying; fishing; and electricity, gas and water. Again, the real story here is that the optimistic CBS projections for services sector might not be realistic and hence the related sub-sectoral growth, contribution to GDP growth rate, and overall GDP growth rate.

In terms of productivity and a meaningful structural transformation with higher value added jobs, the most important sector is industry (specifically, manufacturing sub-sector within it). Unfortunately, manufacturing’s share of GDP is continuously shrinking (revised estimate of 6.28% in FY2012 and projected 6.17% in FY2013). Its growth is projected to drop to 1.85% in FY2013 from 3.63% in FY2012. As mentioned earlier, it points to the persistent supply-side as well as structural constraints.

Interestingly, in US dollar terms, projected per capita GDP for FY2013 ($717) is lower than the actual per capita GDP in FY2011 ($718). Nepalese people are getting poorer! Real per capita GDP growth is projected to slowdown to 2.27% in FY2013 from 3.46% in FY2012.

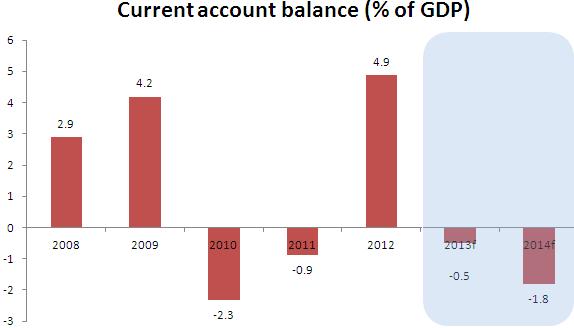

Looking at the GDP figures from expenditure category, it is evident that the economy is overwhelmingly consumption based and imports are rising fast (net exports is expanding on the negative side). No surprise where the remittances are going.

Meantime, while gross domestic savings are declining (down from 14.47% of GDP in FY2011 to projected 9.34% of GDP in FY2013), gross national savings are increasing rapidly (up from 28.56% of GDP in FY2006 to projected 38.41% of GDP in FY2013). Imports of goods and services are projected to reach a record 38.79% of GDP. Exports of goods and services are projected to be just 10.34% of GDP.