Today I attended a discussion forum organized by the Center for Global Development (CGD) in DC. The World Bank President Robert B. Zoellick gave an interesting and insightful speech titled “A Challenge of Economic Statecraft.” Zoellick floated an idea to work with sovereign wealth funds, which amount to almost $3 trillion in assets, to create a “One Percent Solution” for equity investment in Africa. Watch the speech here and read the WB's press release here.

He argued that if only one percent (around $30 billion) of this fund is invested in Africa, the African continent would be able to find its own “sources of growth”….wondering what own “sources of growth” mean? Well, this is kind of diversification of growth (which is not as much affected by the current financial crisis as the West is) China and India are experiencing right now. He wants to invest sovereign wealth funds in Africa so that they could find their own diversified “sources of growth.” Well, I wonder why with already more than $1.3 trillion of aid, the sub-Saharan Africa (SSA) is not still able to find its own “sources of growth”? Is the problem a lack of aid money (volume) or very few effective programs (efficient, down-to-earth) that utilizes local knowledge and stimulates local economy? Bill Easterly, any comments?... Also, he is in favor of more direct cash assistance rather than commodity assistance to effectively tackle hunger and poverty issues. This reminds me of Breakfast and Lunch Program and several other food assistance programs in the US.

He argued that if only one percent (around $30 billion) of this fund is invested in Africa, the African continent would be able to find its own “sources of growth”….wondering what own “sources of growth” mean? Well, this is kind of diversification of growth (which is not as much affected by the current financial crisis as the West is) China and India are experiencing right now. He wants to invest sovereign wealth funds in Africa so that they could find their own diversified “sources of growth.” Well, I wonder why with already more than $1.3 trillion of aid, the sub-Saharan Africa (SSA) is not still able to find its own “sources of growth”? Is the problem a lack of aid money (volume) or very few effective programs (efficient, down-to-earth) that utilizes local knowledge and stimulates local economy? Bill Easterly, any comments?... Also, he is in favor of more direct cash assistance rather than commodity assistance to effectively tackle hunger and poverty issues. This reminds me of Breakfast and Lunch Program and several other food assistance programs in the US.

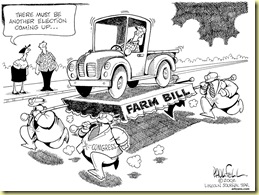

He made good points about finding solutions to the current food crisis and the need to pass the Doha Development Round by 2008. He argued for a “New Deal for Global Food Policy” so that the people in desperate need of food and nutrition are taken care of immediately in the short run and in the long run a sustainable agricultural “Green Revolution” should be created by helping build local food markets and by boosting farm production in the SSA. So, what does the WB did on its part? It invested in knowledge (research) and increased lending for agriculture in Africa from $450 million to $800 million. Again, more aid and lending! Can we reach the same goal by getting rid of astronomical subsidies and agriculture trade restrictions in the West? He is obviously against these restrictive measures though:

He made good points about finding solutions to the current food crisis and the need to pass the Doha Development Round by 2008. He argued for a “New Deal for Global Food Policy” so that the people in desperate need of food and nutrition are taken care of immediately in the short run and in the long run a sustainable agricultural “Green Revolution” should be created by helping build local food markets and by boosting farm production in the SSA. So, what does the WB did on its part? It invested in knowledge (research) and increased lending for agriculture in Africa from $450 million to $800 million. Again, more aid and lending! Can we reach the same goal by getting rid of astronomical subsidies and agriculture trade restrictions in the West? He is obviously against these restrictive measures though:

This moment of decision is not only for the Doha Round. It is for trade itself. Powerful voices across the political spectrum, including in my own country, are calling for, and rationalizing, protectionism. This economic isolationism signals a defeatism that will reap the losses, not the gains, of globalization.

He also talked about Extractive Industries Transparency Initiative (EITI), which basically encourages resource rich countries to publish and verify company payments and revenues from oil, gas and mining so their citizens can hold them more accountable. The WB is now planning to launch EITI++, which would expand EITI to include such areas as the awarding of contracts, improving economic management, and investing revenues effectively in sustainable development.

Overall, it was a good speech. The Q&A session was okay...a lot of time Bob digressed from the main point of the questions. Luckily, there was Nancy Birdsall, President of the CGD, who tried to keep him on track! I met with some professional and academic people during the lunch time. It was nice to build networks while staying in DC. :)...Also, the first picture was taken by my friend Jehea Song using her beloved iphone! :-)

Overall, it was a good speech. The Q&A session was okay...a lot of time Bob digressed from the main point of the questions. Luckily, there was Nancy Birdsall, President of the CGD, who tried to keep him on track! I met with some professional and academic people during the lunch time. It was nice to build networks while staying in DC. :)...Also, the first picture was taken by my friend Jehea Song using her beloved iphone! :-)

Highlights from the speech:

…There is a challenge of statecraft in times such as these: to recognize the changing landscape, often as events and fate rush by, so as to address pressing needs, while also planting seeds that may become the supportive timbers of the future. Today, we need to counter immediate threats while also building an inclusive and sustainable globalization that will offer more sources of growth and innovation for the future, enhance multilateral cooperation to deal with shocks and downturns, and maximize opportunity and hope for all.

… We need a New Deal for Global Food Policy. This New Deal should focus not only on hunger and malnutrition, access to food and its supply, but also the interconnections with energy, yields, climate change, investment, the marginalization of women and others, and economic resiliency and growth. Food policy needs to gain the attention of the highest political levels, because no one country or group can meet these interconnected challenges. Skyrocketing food prices have increased attention to the larger challenge of overcoming hunger and malnutrition, the “Forgotten” U.N. Millennium Development Goal (MDG).

…Hunger and malnutrition are a cause, not just a result, of poverty.

…Hunger and malnutrition are a cause, not just a result, of poverty.

... In many cases, cash or vouchers, as opposed to commodity support, is appropriate and can enable the assistance to build local food markets and farm production. When commodities are needed, purchasing from local farmers can strengthen communities. Funds can buy micro-nutrients customized to locations. School lunch programs draw children to classrooms, while helping healthy kids to learn, and some offer parents food, too.

… A fairer and more open global trading system for agriculture will give more opportunities – and confidence – to African and other developing country farmers to expand production. Taxpayers and governments can save the costs of subsidies, improving budgets.

… The cuts in tariffs in both agriculture and manufactured goods will be through formulae that cut higher figures more than through a straight percentage; higher farm subsidies will also be cut more deeply… These negotiations are not worldwide poker contests, where Ministers hold cards tight, and a winner sweeps the pot of chips. They are complex problem-solving exercises. Everyone must return home with benefits and political explanations.