कोरोनाका कारण देखा परेको विश्वव्यापी आर्थिक मन्दीले हाम्रो कमजोर निर्यात क्षेत्रलाई झन् ठूलो धक्का पु-याउनेछ

कोरोना भाइरस प्रकोप (कोभिड-१९) ले क्षेत्रीय र विश्व अर्थ व्यवस्थामा गम्भीर असर पारिराखेको छ । भाइरसको महामारी कहिले रोकिने हो, ठेगान छैन । धेरै देशसँग त यसलाई जाँच्ने उपकरणसमेत अभाव छ । अहिले यस रोगको खोप पत्ता लगाउन वैज्ञानिक लागिपरेका छन् । छोटो समयमै विश्वव्यापी रूपमा फैलिएको यो भाइरसले दशकौँदेखि स्थापित आपूर्ति शृंखलामा अवरोध ल्याएको छ ।

यसले गर्दा विश्व अर्थतन्त्रमा मन्दी आउन सक्ने प्रारम्भिक पूर्वानुमान गरिएको छ । चिनियाँ सामान र पर्यटकको ठूलो महत्व रहेको हाम्रो अर्थतन्त्रमा सोझै नकारात्मक असर पर्ने देखिन्छ । चीनको हुबेई प्रान्तको राजधानी वुहानमा डिसेम्बर २०१९ मा भाइरस पहिचान भएको थियो । यसले चिनियाँ उत्पादन, आपूर्ति संयन्त्र र अर्थ व्यवस्थामाथि त गम्भीर चोट पु-याइसक्यो नै, भाइरसको विश्वव्यापी फैलावटबाट पैदा हुने अनिश्चितता र वैकल्पिक आपूर्ति शृंखलामा अचानक आघात आएपछि विश्वकै अर्थतन्त्र अहिले जोखिममा छ । विश्वव्यापी कारोबार हुने मध्यवर्ती उत्पादनको २० प्रतिशत चीनमा उत्पादन हुन्छ । सन् २००२ मा यो केबल चार प्रतिशत थियो ।

विश्वव्यापी आपूर्ति शृंखलामा कोरोना भाइरस महामारीको प्रभावबारे ‘युएनसिटिएडी’द्वारा गरिएको प्रारम्भिक विश्लेषणअनुसार सबैभन्दा बढी प्रभावित उत्पादनमा सटीक उपकरण, मेसिनरी, मोटरबाहन, सञ्चार उपकरण, विद्युतीय मेसिनरी, रबर र प्लास्टिक, छालाका सामान, धातु, कागज, पेट्रोरसायन र कपडालगायत पर्छन् । युरोपियन युनियन, अमेरिका, जापान, कोरिया र भियतनाम यसबाट सबैभन्दा बढी प्रभावित हुने अर्थतन्त्र हुन् । कच्चा माल र मध्यवर्ती सामान उत्पादनका लागि चीनमा निर्भर अन्य देश पनि प्रभावित छन् ।

यसबाहेक, कोरोना भाइरसको फैलावटका कारण श्रम, पुँजी र व्यापारमा अवरोध आउँदा धेरै देशमा उत्पादन क्षमता कम हुनेछ । ‘यसैगरी, प्रकोप विकसितहुने ट्रेन्डका आधारमा एशियाई विकास बैंकले विश्वव्यापी प्रभाव ७७ अर्ब डलर देखि ३४६ अर्ब डलरको बीचमा हुन सक्ने प्रारम्भिक आनुमन गरेको छ। र्ती सामानको निर्यातमा दुई प्रतिशतको कटौतीले विश्वव्यापी पचास अरब डलरको उत्पादनमा गिरावट निम्त्याउँछ।

चार मुख्य प्रभाव

महामारीले सन् २००८ को विश्वव्यापी वित्तीय संकट र २०१० मा खाद्यान्नको मुद्रास्र्फीतिको भन्दा बढी नकारात्मक प्रभाव नेपाली अर्थतन्त्रमा पार्ने देखिन्छ । नेपाली अर्थव्यवस्था चार प्रमुख मोर्चामा प्रभावित हुने देखिन्छ । यसले आर्थिक वृद्धि र रोजगारीको अवसरलाई असर गर्नेछ । पहिलो, यात्रा र पर्यटन उद्योग, जुन २०२० मा अपेक्षित वृद्धिका लागि तयारीहुँदै थियो ।

यात्रा प्रतिबन्धले सन् २०२० मा नेपालमा बीस लाख पर्यटक आगमनको आशा अब सपना मात्रै हुनेछ । पर्यटन पूर्वाधार र सेवाका आधारमा बीस लाख पर्यटक लक्ष्य सुरुमै अवास्तविक लक्ष्य थियो । बीस लाख पर्यटक आउने आशामा नयाँ स्थापना गरिएका, निर्माणाधीन र सञ्चालनमा रहेका होटेल र रेस्टुरेन्टका लगानीकर्तालाई ऋण नवीकरण गर्नुपर्ने समस्याले पिरोल्न थालिसकेको छ ।

चीनबाट सबै उडान निलम्बित छन् नै, अन्य देशबाट आउने पर्यटकमा पनि भारी गिरावट आएको छ । गत साल आएका बाह्र लाख पर्यटकमध्ये चौँध प्रतिशत चीनबाट आएका थिए । चिनियाँ पर्यटककै कारण मुलुकको पर्यटन क्षेत्रमा ‘अफ सिजन’ महिना नै घटेको थियो । वर्षभरि कारोबार चलायमान पारी आर्थिक गतिविधि र रोजगारी वृद्धि गर्न अहम भूमिका खेलेको थियो । भाइरसबाट संक्रमित हुने डरले अहिले पर्यटक आगमन ठप्पजस्तै छ । होटेलको औसत ‘अकुपेन्सी’ पैतालीस प्रतिशतभन्दा तल झरेको छ ।

अघिल्ला वर्षमा यो समयमा पचासी प्रतिशतभन्दा धेरै ‘अकुपेन्सी’ हुने गथ्र्यो । मुलुकमा आउने पाहुनामध्ये सत्तरी प्रतिशत छुट्टी र मनोरन्जनका लागि आउ“छन् भने आठ प्रतिशत पदयात्रा र पर्वतारोहण तथा पन्ध्र प्रतिशत तीर्थयात्रा गर्न आउँछन् । यात्रा र पर्यटन उद्योगमा गम्भीर प्रभावका कारण अन्ततः यस वर्ष सेवा क्षेत्रको वृद्धि अनुमान गरेभन्दा धेरै कम हुनेछ । यात्रा र पर्यटन क्षेत्रको प्रत्यक्ष योगदान (होटेल, ट्राभल एजेन्ट, एयरलाइन्स र यात्री यातायात सेवाद्वारा उत्पन्न आर्थिक गतिविधि) को अनुमानित कुल गार्हस्थ उत्पादनको चार प्रतिशतजति छ । यस क्षेत्रले पनि कुल वैदेशिक मुद्रा आयमा ६ प्रतिशत जति योगदान गर्दै आएको छ ।

दोस्रो, आयोजना कार्यान्वयन र समापनमा अवरोध आउनेछ । विशेषगरी, विमानस्थल, जलविद्युत्, सडक यातायातलगायत क्षेत्रका ठूला पूर्वाधार परियोजना समय र लागत वृद्धिका समस्याले पिरोलिनेछन् । केही चिनियाँ कामदार र प्रबन्धकलाई रोजगारी दिइरहेका चिनियाँ ठेकेदारले बनाइरहेका आयोजनामा समस्या देखिसकेको छ । जस्तैः नारायणघाट–बुटवल सडक सुधार परियोजना, रसुवागढी–स्याफ्रुबेँसी सडक परियोजना र काठमाडौं बाहिरी चक्रपथको विस्तृत परियोजना समीक्षालगायत कार्य प्रभावित भइसकेको सूचीमा पर्छन् ।

बिस्तारै अन्य आयोजनाले पनि कच्चा माल र मेसिनरी आभावका कारण समयमै सम्पन्न गर्न नसक्ने सकस व्यहोर्नेछन् । यसले सार्वजनिक पुँजीगत खर्चमा सोझै असर पार्नेछ । परिणामस्वरूप सिमेन्ट र डन्डी उद्योग उत्पादन कटौती गर्न बाध्य हुनेछन् । सरकारले पुँजीगत खर्च बाचा गरेझै बढाउने आशामा धेरै उद्योगले स्थापित क्षमतामा वृद्धि गरेका छन् । पुँजीगत खर्च सोचेभन्दा कम भयो भने ती उद्योग झन् समस्यामा पर्नेछन् । उदाहरणका लागि सिमेन्ट उद्योगको क्षमता उपयोग चालीस प्रतिशतमा झरेको छ । औद्योगिक र पर्यटन क्षेत्रमा उत्पादन र व्यापार कम भई बैंकको ऋण तिर्न नसक्ने अवस्थामा पुग्ने सम्भावना बढेको छ ।

तेस्रो, विश्वव्यापी आपूर्ति शृंखलामा चीनको केन्द्रीय भूमिका रहेको हुँदा प्रकोपले कच्चा माल र मध्यवर्ती सामानको आपूर्तिमा बाधा पु-याउँछ । नेपालका उद्योग तथा सेवा क्षेत्रले उत्पादन गर्ने मालसामानमा कच्चा माल, मध्यवर्ती वा तयारी सामानमा चीन निर्भरता धेरै छ । मुलुकको कुल व्यापारमा चीनबाट आउने सामानको पन्ध्र प्रतिशत हिस्सा छ । अरू देशमा चिनियाँ कच्चा माल र मध्यवर्ती सामान प्रयोग गरेर बनाइएका सामान पनि नेपाली उद्योगले प्रयोग गर्छन् । चीन निर्यात हुने शीर्ष वस्तुमा हस्तशिल्प, ऊनी कार्पेट, चाउचाउ र तयारी पोसाक पर्छन् । यस्तै, दूरसञ्चार उपकरण, तयारी पोसाक, विद्युतीय सामान, मेसिनरी पार्ट्स र रसायनिक मल चीनबाट आयात हुने शीर्ष वस्तु हुन् । विश्वव्यापी आर्थिक मन्दीले चीनबाहेक हाम्रा वस्तु र सेवाको मागलाई पनि कमजोर बनाउने पक्का छ । यसले हाम्रो कमजोर निर्यात क्षेत्रलाई झन् ठूलो धक्का पुग्नेछ ।

चौथो, ‘माइग्रेसन’ र रेमिट्यान्स प्रवाह प्रभावित हुनेछन् । सरकारले दक्षिण कोरियाजस्तो आकर्षक गन्तव्यमा बहिर्गमन निलम्बित गरिसकेको छ । त्यस्तै, खाडी देशमा वैदेशिक रोजगारीमा कडाइ गरेको छ । यी देशमा आपूर्ति र आर्थिक अवरोधका साथै विश्व आर्थिक मन्दीले लगानी घट्ने सम्भावना छ । यस्तो भयो भने हाम्रो रेमिट्यान्स आयमा ठूलो धक्का लाग्नेछ र बाह्य क्षेत्र झन् कमजोर हुनेछ । रेमिट्यान्सको आडमा धानिएको हाम्रो अर्थतन्त्रमा कत्रो धक्का लाग्छ, अहिल्यै अनुमान गर्न गाह्रो छ । यसका अलावा वित्तीय, मौद्रिक र बाह्य क्षेत्रमा पनि प्रभाव पर्नेछ । जस्तै, आयात कम हुनेबित्तिकै सरकारको राजस्व घट्छ ।

कर राजस्वको पैतालिस प्रतिशत त भन्सार र अन्तर्राष्ट्रिय व्यापारमा असुलिने करबाट संकलन हुन्छ । यस्तो हुँदा वित्तीय घाटा बढ्ने सम्भावना बढ्छ । उद्योगीले लिएको ऋण समयमै तिर्न नसक्दा खराब कर्जाको अनुपात बढ्न जान्छ । रेमिट्यान्स प्रवाहमा कमी आउँदा बैंकमा तरलताको समस्या हुन्छ । उद्योगले ऋण तिर्न नसक्दा खराब ऋणको मात्रा बढेर तरलतामै समस्या आउन सक्छ ।

आर्थिक वृद्धिमा धक्का

आर्थिक वर्ष ०७६ र ७७ को बजेटको मध्यावधि समीक्षाको क्रममा अर्थमन्त्री डा. युवराज खतिवडाले सरकारले जसरी पनि आठ दशमलव पाँच प्रतिशत आर्थिक वृद्धि लक्ष्यलाई भेट्ने अथवा त्यसैको नजिक रहने ठोकुवा गरेका थिए । उनले सरकारले खर्च गर्छु भनेर विनियोजन गरेको पुँजीगत खर्चको लक्ष्य घटाउँदा पनि आर्थिक वृद्धिको लक्ष्य नघटाउँदा अर्थशास्त्रीहरू कुनचाहिँ आर्थिक मोडेलको आडमा उनले यस्तो ठोकुवा गर्दैछन् भनेर अचम्मित भएका छन् ।

अरू कुनै उल्लेखनीय आर्थिक काम नभए पनि र निजी क्षेत्र अझै चलायमान नभएको अवस्थामा अब झन् अर्थिक वृद्धिदरको लक्ष्यमा यथार्थवादी हुन जरुरी छ । वास्तवमा कोरोना भाइरसको प्रकोपअघि पनि आर्थिक गतिविधि अपेक्षाभन्दा कमजोर नै थियो । यस वर्ष कृषि उत्पादन खासगरी धानको उत्पादन घट्ने पूर्वानुमान सरकारले नै गरेको छ । ढिलो मनसुन, मलको अभाव, गुणस्तरहीन बिउको प्रयोग र फौजी कीराको आक्रमणले कृषि उत्पादनमा नकारात्मक असर पर्नेछ । सार्वजनिक खर्चमा ढिलासुस्तीले औद्योगिक उत्पादनमा असर पारेको छ । विशेषगरी, निर्माण र खानी तथा उत्खनन गतिविधि प्रभावित भएको छ । चालू आर्थिक वर्षको पहिलो ६ महिनामा सरकारले चार खर्ब आठ अर्ब पुँजीगत बजेटको पन्ध्र प्रतिशत मात्र खर्च गर्न सकेको छ । यो अघिल्लो वर्षको भन्दा सुधार होइन ।

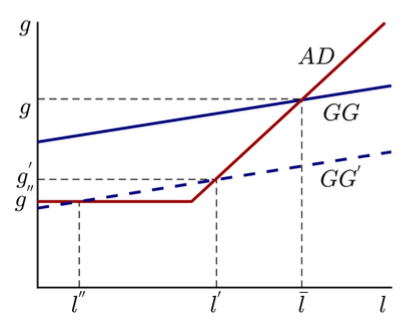

यी कारणका साथै भारतीय अर्थतन्त्रमा पनि आर्थिक मन्दी आएका वेला अब यथार्थवादी भएर आर्थिक वृद्धिको लक्ष्य नघटाइ हुन्न । एसियाली विकास बैंक, अन्तर्राष्ट्रिय मुद्राकोष र विश्व बैंकले नेपालको आर्थिक वृद्धि ६ प्रतिशतको सेरोफेरोमा हुने पूर्वानुमान महामारी फैलिनुअघि गरेका थिए । अबको अद्यावधिक पूर्वानुमान पाँच प्रतिशतको सेरोफेरोमा हुने सम्भावना प्रबल छ । छिट्टै कोरोना भाइरसको महामारी नियन्त्रणमा नआई विश्व अर्थतन्त्रमा प्रभाव गहिरिँदै गए अर्को आर्थिक वर्ष पनि आर्थिक वृद्धिमा धक्का लाग्नेछ ।

नीतिगत औजार

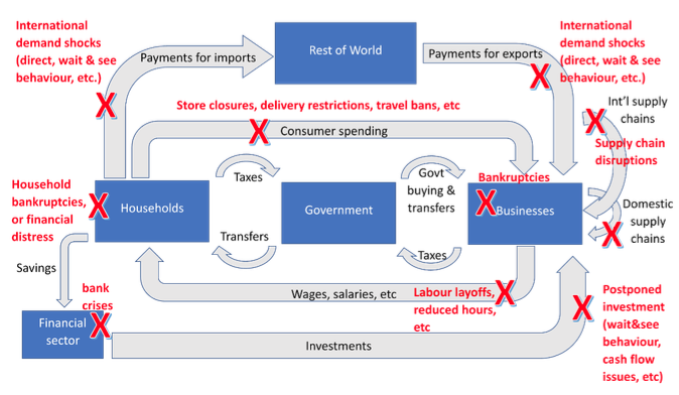

संकुचित वित्तीय अवस्था र बजेट कार्यान्वयनमा कमजोर क्षमताका कारण सरकारले तत्काल आर्थिक वृद्धि बढाउन गर्न सक्ने काम थोरै छ । वित्तीय प्रोत्साहन गर्ने नीतिभन्दा पनि तत्कालका लागि कोरोना भाइरस संक्रमण बढ्न नदिनका लागि सम्बन्धित निकायलाई चाहिएजति बजेट विनियोजन र रकमान्तर प्राथमिकता हुनुपर्छ । बजार अनिश्चितताको फाइदा लिई आपूर्तिकर्ताले कृत्रिम मूल्यवृद्धि गर्दैनन् भन्ने सुनिश्चित गर्न सरकारले बजार अनुगमन तीव्र पार्नुपर्छ । कोरोना भाइरसको असरले माग र आपूर्ति दुवै पक्षमा धक्का दिरहेको छ । घट्दो रेमिट्यान्स र आर्थिक मन्दीका कारण श्रमिकको आय कम हुन्छ भने उपभोग र लगानीमा पनि ह्रास आउँछ ।

विश्वव्यापी आर्थिक मन्दीले हाम्रो वस्तु र सेवाको माग कम गर्नेछ । यस्तो ‘डिमान्ड सक’ निराकरण गर्न वित्तीय प्रोत्साहन नीति चाहिन्छ । वित्तीय नीतिले प्रकोपविरुद्ध अझ राम्रो तयारी गर्न र स्वास्थ्य सेवाका लागि उपलब्ध वित्तीय स्रोतको खोजीमा महत्वपूर्ण भूमिका खेल्न सक्छ । तर, हाम्रो वित्तीय अनुशासन त्यति राम्रो नभएका कारण सरकारले केही गर्न सक्ने अवस्था देखिँदैन । अहिले गर्न सक्ने भनेको स्वास्थ्य क्षेत्रमा सक्दो धेरै आपतकालीन बजेट विनियोजन अथवा रकमान्तर नै हो ।

वाणिज्य मन्त्रालयले बजार अनुगमन गर्न आवश्यक जनशक्ति तथा रकम विनियोजन गर्न सक्छ । सरकारले व्यापारमा मन्दी आएका उद्योगलाई कर प्रोत्साहनका साथै मास्क र औषधि उत्पादनमा प्रत्यक्ष अनुदान दिन सक्छ । निजी अस्पताललाई उपचारका लागि तयार रहन प्रोत्साहित गर्न सक्छ । ‘आइसोलेसन’ को बन्दोबस्त गर्न कर सुविधा वा सहुलियत दिन सक्छ । प्रभावित परियोजनाका लागि समय र लागत बढ्न नदिन सरकारले विशेष व्यवस्था गर्न सक्छ ।

त्यस्तै, हाम्रा उद्योग र सेवा क्षेत्रले प्रयोग गर्ने आयातीत कच्चा माल, मध्यवर्ती सामान वा अन्तिम सामानको आपूर्तिमा समस्या आएर उत्पादन गर्न नसक्दा आपूर्ति सक (सप्लाई सक) आउन सक्छ । क्षमता उपयोग र उत्पादन सीमित पार्न सक्छ । परम्परागत मौद्रिक नीतिका उपकरणले गर्न सक्ने कमै छ । अपरम्परागत मौद्रिक नीतिका औजारले उत्पादन तत्काल नबढाए पनि व्यापार र व्यापारीलाई सहजता प्रदान गर्न सक्छ । उदाहरणका लागि राष्ट्र बैंकले क्रेडिट र ऋणको बोझ कम गर्न सक्ने मौद्रिक औजार ल्याउन सक्छ ।

रोलिङ पुनर्वृत्त सुविधा र ऋणको ब्याज तिर्न केही समयका लागि स्थगित वा माफीजस्ता औजार भूकम्पपछि पनि ल्याइएको थियो । राष्ट्र बैंकले लघु र मझौला उद्यमका लागि किफायती र पहुँचयोग्य कर्जा सुविधा घोषणा गर्न सक्छ । अन्तर्राष्ट्रिय विकास संस्थाद्वारा प्रदान गरिएको आपतकालीन ऋण सुविधा उपयोग गरेर वित्तीय र बाह्य तनावलाई सम्बोधन गर्न सकिन्छ ।

उदाहरणका लागि एसियाली विकास बैंकले नेपाललगायत धेरै देशमा प्राकृतिक प्रकोपपछि थप ऋण र अनुदान स्वीकृत गर्छ । आइएमएफले द्रुत ऋण सुविधा प्रदान गर्छ र अवस्था हेरर ऋण मिनाहा तथा देशको कोटाभन्दा थप धेरै ऋण प्रदान गर्छ । यसैगरी, विश्व बैंकले विकासशील सदस्य देशहरूलाई आवश्यक पर्ने वित्त पोषणका लागि प्रतिक्रिया दिन बाह्र अर्ब डलर प्रतिबद्धता गरिरहेको छ ।